UPDATE: July 30, 2021 – Extensions to COVID-19 support programs

On July 30, the Government of Canada announced the extension of crucial COVID-19 support measures for Canadians and Canadian businesses,. These extensions include:

- Extending the eligibility period for the Canada Emergency Wage Subsidy, the Canada Emergency Rent Subsidy and Lockdown Support until October 23, 2021, and increasing the rate of support employers and organizations can receive during the period between August 29 and September 25, 2021.

- Extending the Canada Recovery Benefit (CRB), the Canada Recovery Caregiving Benefit (CRCB), and the Canada Recovery Sickness Benefit (CRSB) until October 23, 2021.

- Increasing the maximum number of weeks available for the CRB, by an additional 4 weeks, to a total of 54 weeks, at a rate of $300 per week, and ensuring it is available to those who have exhausted their employment insurance (EI) benefits.

In addition, the government is proposing to offer businesses greater flexibility when calculating the revenue decline used to determine eligibility for the wage and rent subsidy programs and the new Canada Recovery Hiring Program. The government is also releasing draft legislation that provides further clarity on previously announced changes to the wage subsidy for furloughed employees.

Canada Emergency Wage Subsidy, Canada Emergency Rent Subsidy and Lockdown Support Extension

The wage subsidy, rent subsidy and Lockdown Support were set to expire in June 2021. Budget 2021 extended these measures until September 25, 2021 and provided the government with the authority to further extend the programs through regulations should the economic and public health situation warrant it. Today, the government is proposing to use this authority to further extend these measures until October 23, 2021, and increase the wage and rent subsidy rates between August 29 and September 25, 2021.

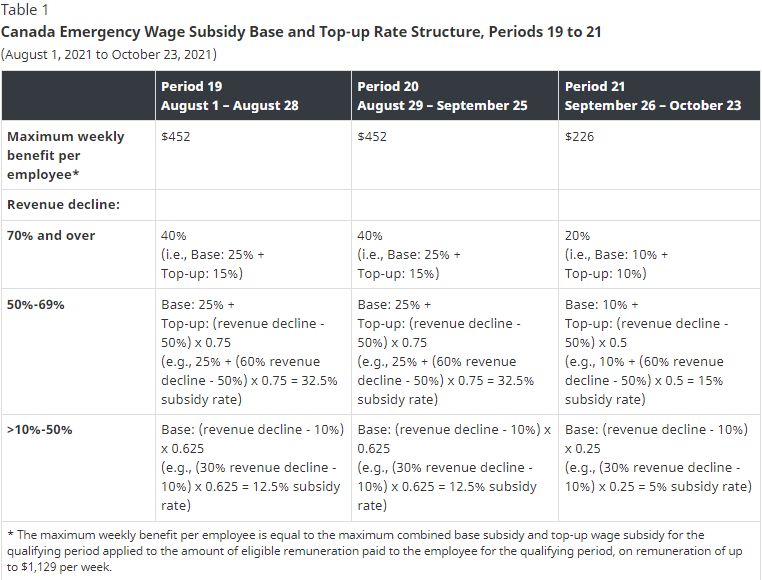

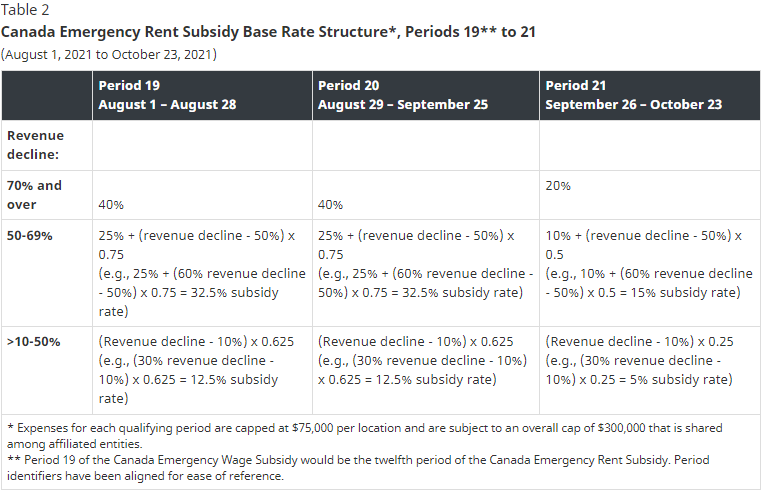

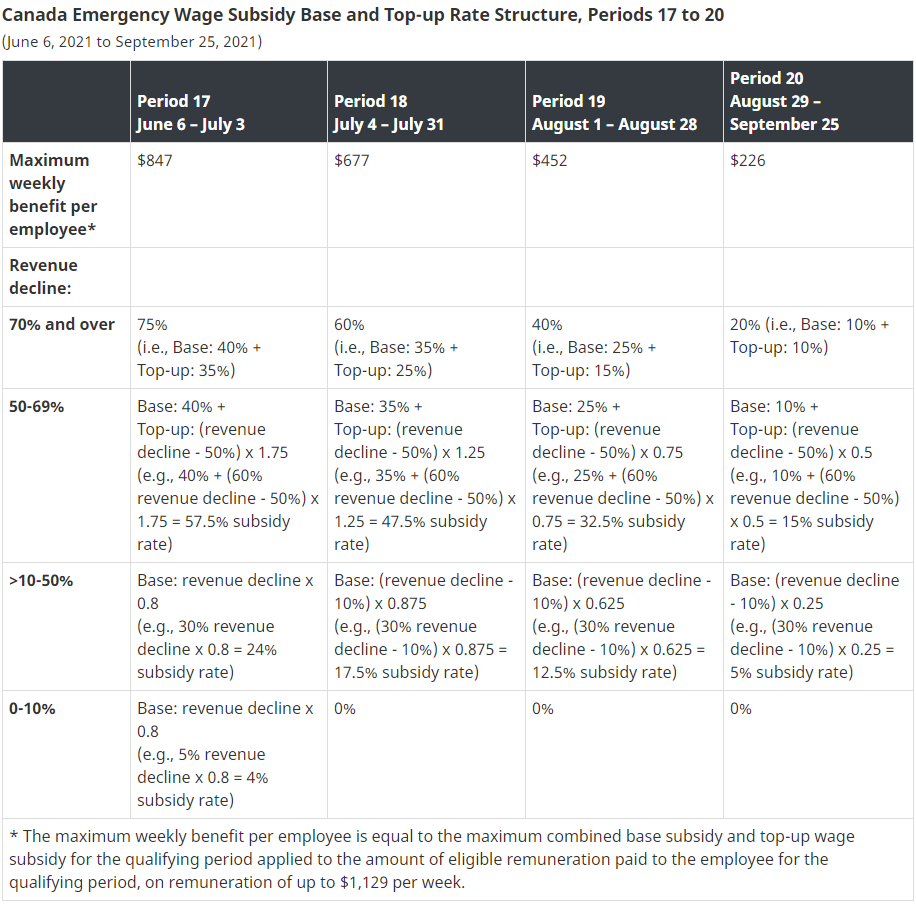

Specifically, the maximum rate for the wage and rent subsidies would be set at 40 per cent in Period 20 (August 29 to September 25) instead of being reduced to 20 per cent, as announced in Budget 2021. These programs would also be extended by one additional period, with a maximum rate of 20 per cent in Period 21 (September 26 to October 23). The Lockdown Support would also be extended until October 23, 2021, at its set rate of 25 per cent.

Eligible employers would still also be able to apply for the new Canada Recovery Hiring Program instead of the wage subsidy if they so choose. The hiring program provides alternative support for businesses affected by the pandemic and helps them hire workers, and increase workers’ hours or wages, as the economy reopens. The hiring program is available from June 6, 2021 until November 20, 2021, allowing employers to shift from the Canada Emergency Wage Subsidy to this new support, at a pace that works for them.

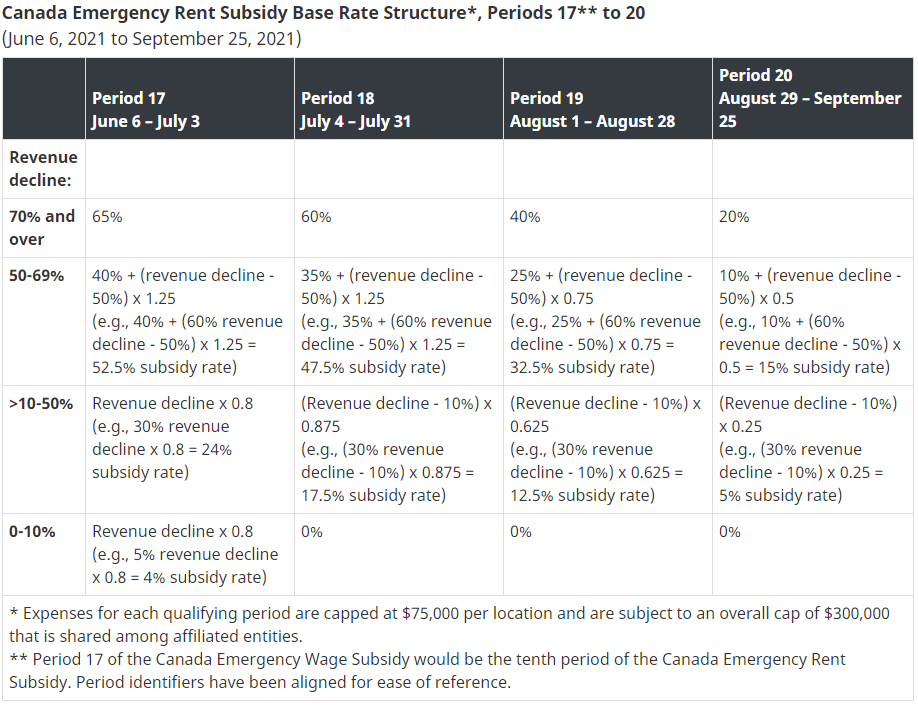

Tables 1 and 2, below, detail the proposed wage and rent subsidy rate structures from August 1, 2021 to October 23, 2021. Only employers experiencing a decline in revenues of more than 10 per cent are eligible for this support.

Revenue Decline Calculation

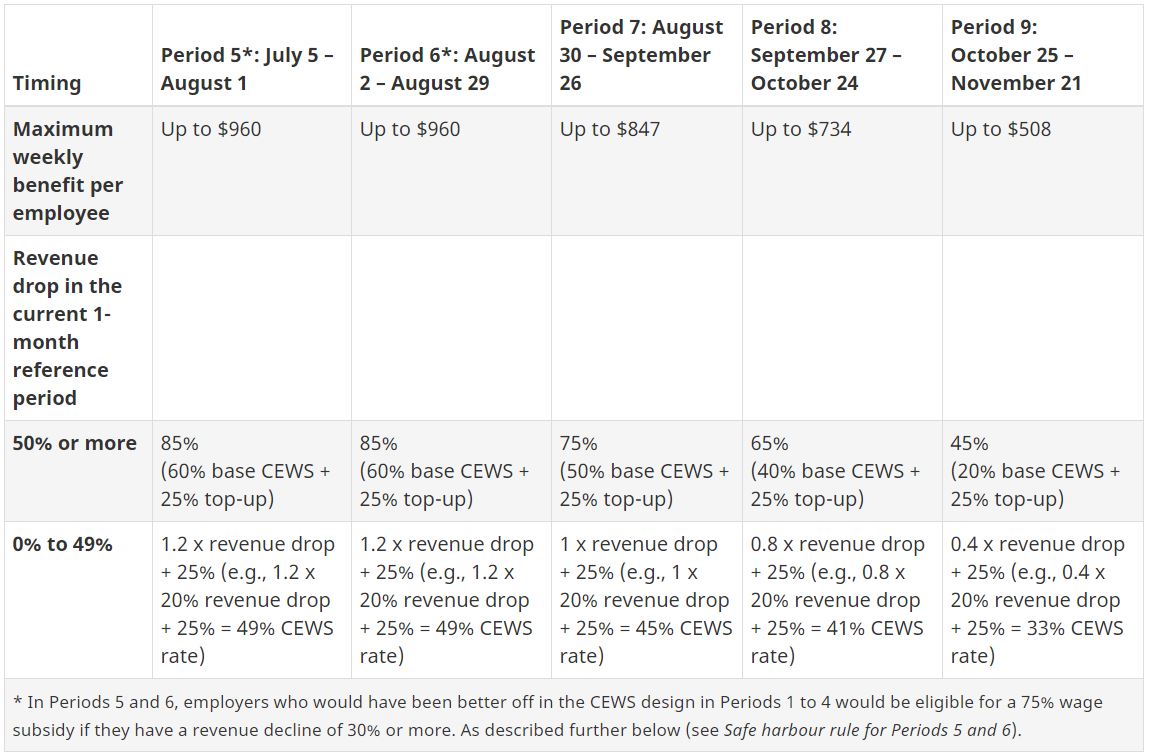

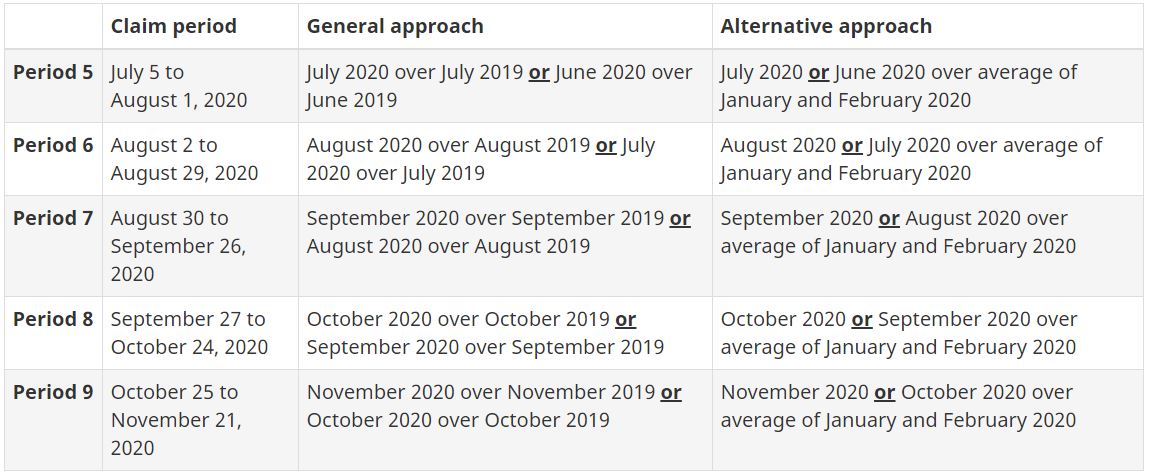

For the purposes of the wage subsidy, rent subsidy, and the Canada Recovery Hiring Program, an employer’s decline in revenues is generally determined by comparing the employer’s revenues in a current calendar month with its revenues in the same calendar month, pre-pandemic (this is known as the general approach). An employer may also elect to use an alternative approach, which compares the employer’s monthly revenues relative to the average of its January 2020 and February 2020 revenues.

An eligible employer that was not carrying on a business, or otherwise not carrying on its ordinary activities, on March 1, 2019 can only use the alternative approach for Periods 1 to 4 (March 15 to July 4, 2020). For Period 5 and beyond (i.e., as of July 5, 2020), these employers can either continue using the alternative approach or switch to the general approach. However, once an approach is chosen, the employer is required to use the same approach for all qualifying periods as of Period 5.

As of Period 14 (March 14 to April 10, 2021), the prior reference periods used under the general approach reverted to calendar months from 2019, ensuring that organizations continue to calculate their decline in revenues relative to a pre-pandemic month. However, this change may lead to unintended consequences for certain organizations that were not operating on March 1, 2019. For example, a business that began operating in May 2019 that switched from the alternative approach to the general approach from Period 5 onwards would be required to use April 2019 as its prior reference period for Period 15, even though it would have had no revenue during this month. This would make it ineligible for the subsidy support during this qualifying period as it would be unable to demonstrate a decline in revenues.

To provide greater flexibility to organizations in these circumstances, the government proposes to allow an eligible organization to elect to use the alternative approach to calculate its revenue decline for Periods 14 to 17 (March 14 to July 3, 2021) if it was not carrying on a business or otherwise carrying on ordinary activities on March 1, 2019. Subject to approval by the Governor in Council, these changes would align the rules for Periods 14 to 17 (March 14 to July 3, 2021) with those for Periods 1 to 4 (March 15 to July 4, 2020) for organizations that began operating between March 1, 2019 and the onset of the pandemic, making them eligible for continued support under these programs.

Wage Subsidy Support for Furloughed Employees

To ensure that the wage subsidy for furloughed employees remains aligned with benefits available under the Employment Insurance (EI) program, Budget 2021 extended the wage subsidy for furloughed employees so that the weekly wage subsidy for a furloughed employee from June 6, 2021 to August 28, 2021 (Periods 17 to 19) is the lesser of:

- the amount of eligible remuneration paid in respect of the week; and

- the greater of:

- $500; and

- 55 per cent of pre-crisis remuneration for the employee, up to a maximum subsidy amount of $595.

The wage subsidy for furloughed employees continues to be available to eligible employers that qualify for the wage subsidy for active employees for the relevant period until August 28, 2021. Employers also continue to be entitled to claim under the wage subsidy their portion of contributions in respect of the Canada Pension Plan, EI, the Quebec Pension Plan and the Quebec Parental Insurance Plan for furloughed employees.

As announced in Budget 2021 and to provide certainty to employers and employees, the government intends to introduce legislative proposals to clarify that the wage subsidy for furloughed employees would no longer be available after August 28, 2021, including the subsidy for the employer’s portion of contributions under the Canada Pension Plan, EI, the Quebec Pension Plan and the Quebec Parental Insurance Plan in respect of furloughed employees.

UPDATE: July 21, 2021 – CRHP is open for application

The new Canada Recovery Hiring Program (CRHP) is now open for application. The CRHP provides eligible employers with a subsidy of up to 50 per cent of incremental remuneration paid to eligible active employees between June 6, 2021, and November 20, 2021.

The first claim period, period 17 (numbered as such to align with the Canada Emergency Wage Subsidy periods), covers the period from June 6 to July 3, 2021 and is now open for application. The deadline to apply is December 30, 2021. Remember, eligible employers can claim either the CEWS or the CRHP, but not both.

The CRHP application site, the CRA calculator, and technical Q&A are all now available for guidance. To learn more about the Canada Recovery Hiring Program, visit our COVID-19 Hub.

UPDATE: July 21, 2021 – Applications open for Tourism Relief Fund

The Tourism Relief Fund (TRF), administered by Canada’s regional development agencies and Innovation, Science and Economic Development Canada (ISED), is a $500-million national program to support the tourism sector in Canada. The TRF will help position Canada as a destination of choice when domestic and international travel is once again deemed safe, by:

- empowering tourism businesses to create new or enhance existing tourism experiences and products to attract more local and domestic visitors

- helping the sector reposition itself to welcome international visitors, by providing the best Canadian tourism experiences we have to offer the world

Initiatives under this fund will help tourism businesses and organizations adapt their operations to meet public health requirements, improve their products and services, and position themselves for post-pandemic economic recovery. A minimum of $50 million of the TRF will specifically support Indigenous tourism initiatives. For more information and to apply, contact your regional development agency.

Contributions to businesses will be either non-repayable (contributions up to $100,000) or repayable (contributions up to $500,000). Not-for-profit organizations and Indigenous organizations (not generating profits) will be eligible for non-repayable contributions.

To find out if your organization qualifies for TRF funding and to apply, visit your regional development agency‘s web page:

- Atlantic Canada Opportunities Agency (ACOA)– For communities in Atlantic Canada

- Canada Economic Development for Quebec Regions (CED) – For communities in Quebec

- Canadian Northern Economic Development Agency (CanNor)- For communities in Canada’s three territories

- Federal Economic Development Agency for Southern Ontario (FedDev Ontario) – Forcommunities in southern Ontario

- FedNor -For communities in northern Ontario

- Western Economic Diversification Canada (WD) – For communities in Western Canada

Other funding support measures for tourism businesses:

UPDATE: July 21, 2021 – Applications open for Canada Community Revitalization Fund

The Canada Community Revitalization Fund (CCRF) is a two-year, $500 million national infrastructure program to revitalize communities across Canada. Not-for-profit organizations, municipalities and other public institutions, and Indigenous communities can apply for funding for projects that aim to:

- revitalize downtown cores and main streets

- reinvent outdoor spaces

- create green infrastructure

- increase the accessibility of community spaces

Examples of projects that could receive funding under this program include:

- farmers markets

- community and cultural centres

- parks or community gardens

- recreational trails and public outdoor sports facilities

- multi-purpose centres

Projects funded under the CCRF could receive a maximum contribution of up to $750,000 or $1 million (depending on project location), with funding to cover up to 75% of the total project costs. Indigenous community projects may qualify for funding to cover 100% of total project costs. All contributions will be non-repayable.

Indigenous applicants to the Canada Community Revitalization Fund (CCRF) may request additional time to submit applications, taking into account that the CCRF is a time-limited initiative ending March 31, 2023. For more information, Indigenous applicants are asked to contact their respective Regional Development Agency as early as possible prior to July 23, 2021.

To find out if your community qualifies for CCRF funding and to apply, visit your Regional Development Agency’s web page:

Atlantic Canada Opportunities Agency (ACOA) -For communities in Atlantic Canada

Canada Economic Development for Quebec Regions (CED)-For communities in Quebec

Canadian Northern Economic Development Agency (CanNor) -For communities in Canada’s three territories

Federal Economic Development Agency for Southern Ontario (FedDev Ontario) -For communities in southern Ontario

Federal Economic Development Initiative for Northern Ontario (FedNor) –For communities in northern Ontario

Western Economic Diversification Canada (WD) -For communities in Western Canada

UPDATE: April 22, 2021 – Federal Budget includes key COVID-19 support measures

The federal budget tabled on April 19, 2021 includes a number of COVID-19 support measures. These include extensions and adjustments to the Canada Emergency Wage Subsidy (CEWS), Canada Emergency Rent Subsidy (CERS) and Lockdown Support programs, the introduction of a new Canada Recovery Hiring Program (CRHP), and a change to the taxation of COVID-19 benefits. Below is a summary of these measures.

Canada Emergency Wage Subsidy

Budget 2021 proposes to extend the Canada Emergency Wage Subsidy until September 25, 2021. Budget 2021 also proposes to provide the government with the legislative authority to add additional qualifying periods until November 20, 2021, should the economic and public health situation warrant it.

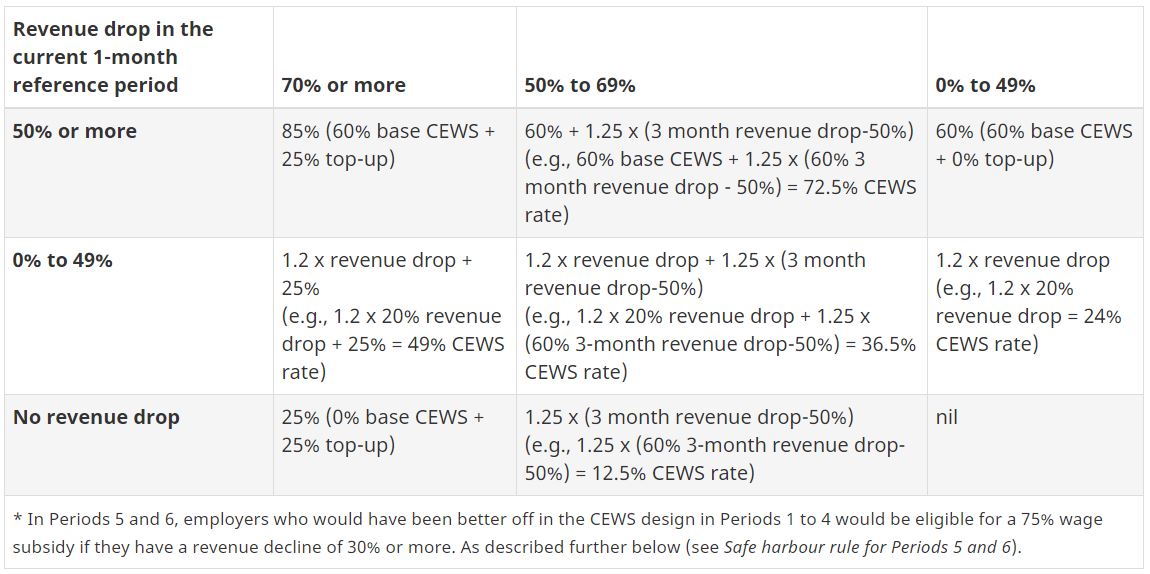

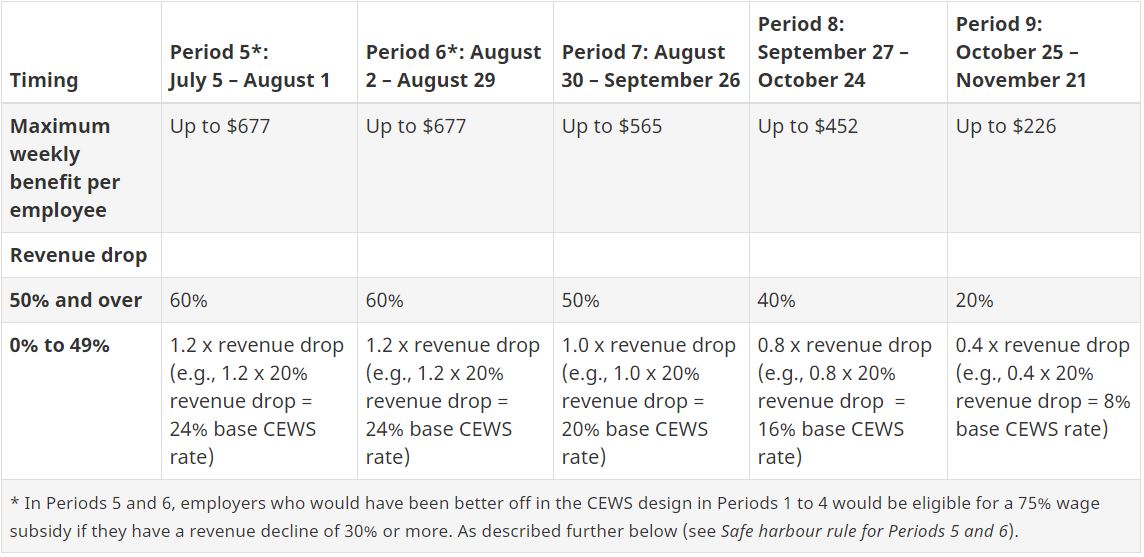

The maximum combined base subsidy and top-up wage subsidy rate for active employees is currently set at 75 per cent through the qualifying period ending on June 5, 2021. Budget 2021 proposes the maximum wage subsidy rates be gradually phased out starting on July 4, 2021, from 60%, to 40%, and finally to 20%, as set out in the table below.

Further, only employers with a decline in revenues of more than 10 per cent would be eligible for the wage subsidy as of July 4.

Furloughed Employees

To ensure that the wage subsidy for furloughed employees remains aligned with benefits available under EI, Budget 2021 proposes that the weekly wage subsidy for a furloughed employee from June 6, 2021 to August 28, 2021 be the lesser of:

- the amount of eligible remuneration paid in respect of the week; and

- the greater of:

- $500; and

- 55 per cent of pre-crisis remuneration for the employee, up to a maximum subsidy amount of $595.

The wage subsidy for furloughed employees would continue to be available to eligible employers that qualify for the wage subsidy for active employees for the relevant period until August 28, 2021. Employers will also continue to be entitled to claim under the wage subsidy their portion of contributions in respect of the Canada Pension Plan, EI, the Quebec Pension Plan and the Quebec Parental Insurance Plan in respect of furloughed employees.

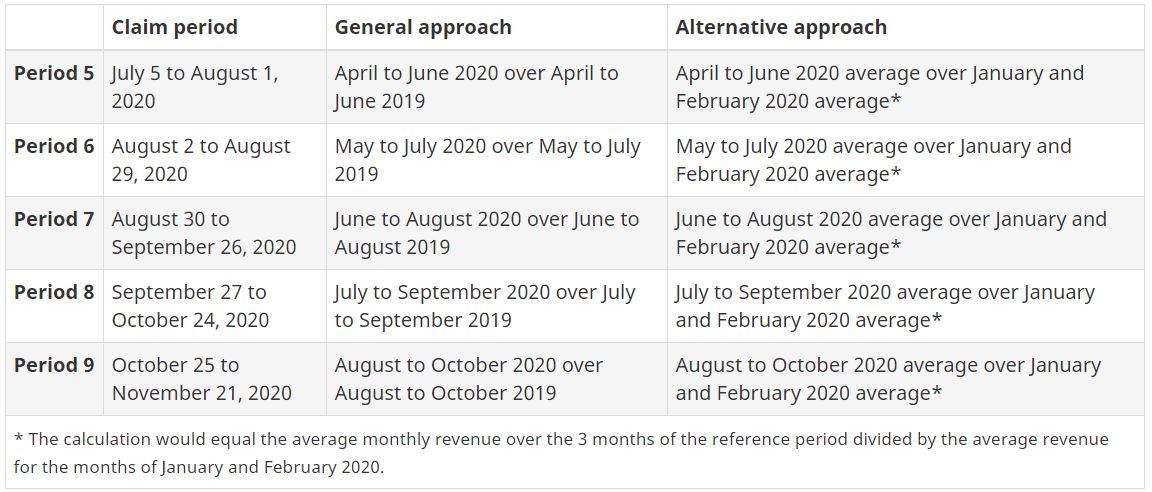

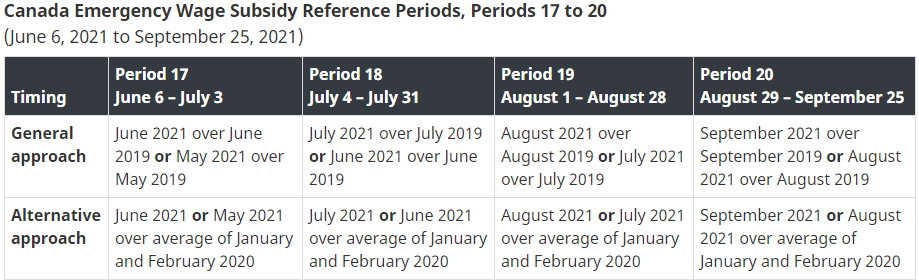

Reference Periods

Budget 2021 proposes the reference periods to be used to determine an employer’s revenue decline for the qualifying periods from June 6, 2021 to September 25, 2021 to continue to follow the current methodology, and is further set out in the table below.

Employers that had chosen to use the general approach for prior periods would be required to continue to use that approach. Similarly, employers that had chosen to use the alternative approach would be required to continue to use the alternative approach.

Baseline Remuneration

Baseline remuneration means the average weekly eligible remuneration paid to an eligible employee by an eligible employer during the period beginning January 1, 2020 and ending March 15, 2020. However, the eligible employer may elect, for each qualifying period in respect of an employee, an alternative baseline period for calculating the average weekly eligible remuneration. Budget 2021 proposes to allow an eligible employer to elect to use the following alternative baseline remuneration periods:

- March 1 to June 30, 2019 or July 1 to December 31, 2019, for the qualifying period between June 6, 2021 and July 3, 2021; and

- July 1 to December 31, 2019, for qualifying periods beginning after July 3, 2021.

Requirement to Repay Wage Subsidy

Budget 2021 proposes to require a publicly listed corporation to repay wage subsidy amounts received for a qualifying period that begins after June 5, 2021 in the event that its aggregate compensation for specified executives during the 2021 calendar year exceeds its aggregate compensation for specified executives during the 2019 calendar year.

Canada Emergency Rent Subsidy

Budget 2021 proposes to extend the Canada Emergency Rent Subsidy and the Lockdown Support until September 25, 2021. Budget 2021 also proposes to provide the government with the legislative authority to add additional qualifying periods for the rent subsidy and the Lockdown Support until November 20, 2021, should the economic and public health situation warrant it.

Rate Structure

The maximum base rent subsidy rate is currently set at 65 per cent through the qualifying period ending on June 5, 2021. Budget 2021 proposes the rent subsidy rates be gradually phased out starting on July 4, 2021, from 60%, to 40%, and finally to 20%, as set out in the table below.

Further, only organizations with a decline in revenues of more than 10 per cent would be eligible for the base rent subsidy and, as discussed below, the Lockdown Support, as of July 4, 2021.

Revenue-Decline Calculation

Both the rent subsidy and the wage subsidy use the same calculation to determine an organization’s revenue decline. As a result, the same reference periods are used to calculate an organization’s decline in revenues for the wage subsidy and the rent subsidy. Likewise, if an organization elects to use an alternative method for computing its revenue decline under the wage subsidy, it must use that alternative method for the rent subsidy.

Purchase of Business Assets

In order to qualify for the wage subsidy, an applicant must have had a payroll account with the Canada Revenue Agency (or engaged a qualifying payroll service provider). For the purpose of the rent subsidy, an applicant is required to have a business number with the CRA. If certain conditions are met, the wage subsidy rules provide that an eligible entity that purchases the assets of a seller will be deemed to meet the payroll account requirement if the seller met the requirement. Budget 2021 proposes to introduce a similar deeming rule that would apply in the context of the rent subsidy, where the seller met the business number requirement. This measure would apply as of the start of the rent subsidy.

Lockdown Support

Budget 2021 proposes to extend, for the qualifying periods from June 6, 2021 to September 25, 2021, the current 25-per-cent rate for the Lockdown Support.

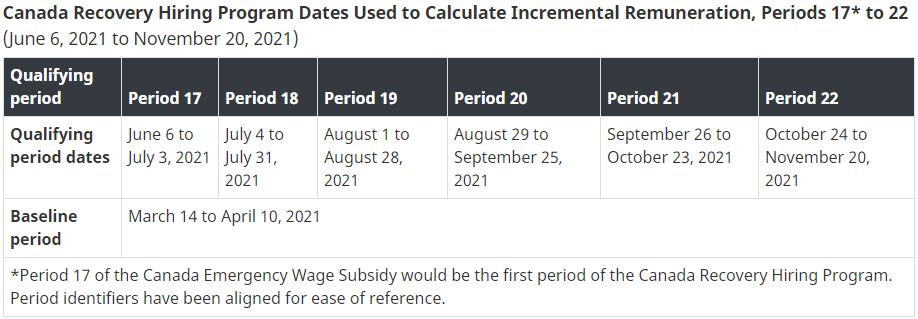

Canada Recovery Hiring Program

Budget 2021 proposes to introduce the new Canada Recovery Hiring Program to provide eligible employers with a subsidy of up to 50 per cent on the incremental remuneration paid to eligible employees between June 6, 2021 and November 20, 2021. An eligible employer would be permitted to claim either the hiring subsidy or the Canada Emergency Wage Subsidy for a particular qualifying period, but not both.

Eligible Employers

Employers eligible for the Canada Emergency Wage Subsidy would generally be eligible for the hiring subsidy. However, a for-profit corporation would be eligible for the hiring subsidy only if it is a Canadian-controlled private corporation (including a cooperative corporation that is eligible for the small business deduction). Other eligible employers would include individuals, non‑profit organizations, registered charities, and certain partnerships. Corporations and trusts that are ineligible for the Canada Emergency Wage Subsidy because they are public institutions would not be eligible for the hiring subsidy. Public institutions generally include municipalities and local governments, Crown corporations, wholly owned municipal corporations, public universities, colleges, schools and hospitals. Eligible employers (or their payroll service provider) would be required to have had a payroll account open with the Canada Revenue Agency on March 15, 2020.

Eligible Employees

An eligible employee must be employed primarily in Canada by an eligible employer throughout a qualifying period (or the portion of the qualifying period throughout which the individual was employed by the eligible employer).

The hiring subsidy would not be available for furloughed employees (on leave with pay). An employee would not be considered to be on leave with pay for the purposes of the hiring subsidy if they are on a period of paid absence, such as vacation leave, sick leave, or a sabbatical.

Eligible Remuneration and Incremental Remuneration

The types of remuneration eligible for the Canada Emergency Wage Subsidy would also be eligible for the hiring subsidy. Eligible remuneration generally includes salary, wages, and other remuneration for which employers are required to withhold or deduct amounts on account of the employee’s income tax obligations. However, it does not include severance pay, or items such as stock option benefits or the personal use of a corporate vehicle. The amount of remuneration for employees would be based solely on remuneration paid in respect of the qualifying period.

Incremental remuneration for a qualifying period means the difference between an employer’s total eligible remuneration paid to eligible employees for the qualifying period and its total eligible remuneration paid to eligible employees for the baseline period. In both the qualifying period and the baseline period, eligible remuneration for each eligible employee would be subject to a maximum of $1,129 per week.

As is currently the case for the Canada Emergency Wage Subsidy, the eligible remuneration for a non-arm’s length employee for a week could not exceed their baseline remuneration determined for that week. More information on baseline remuneration is available in the supplementary information on Emergency Business Supports.

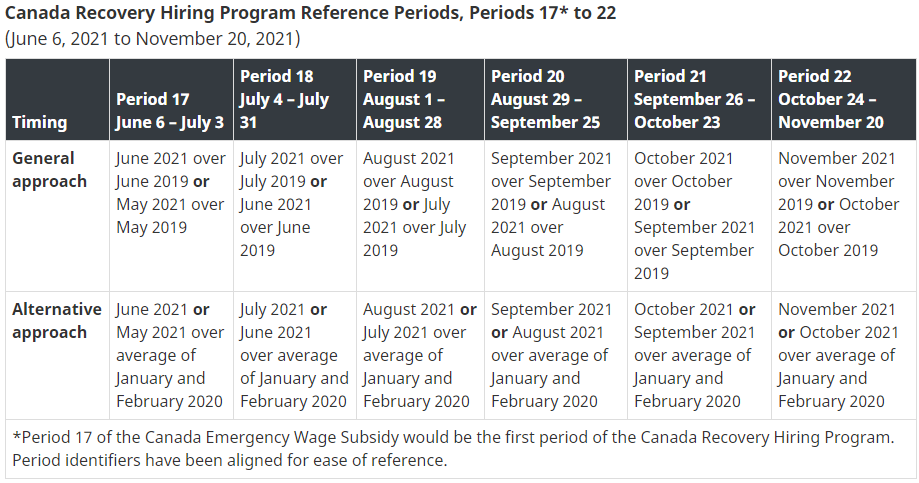

The applicable dates for the calculation of the incremental remuneration are shown in the table below.

Subsidy Amount

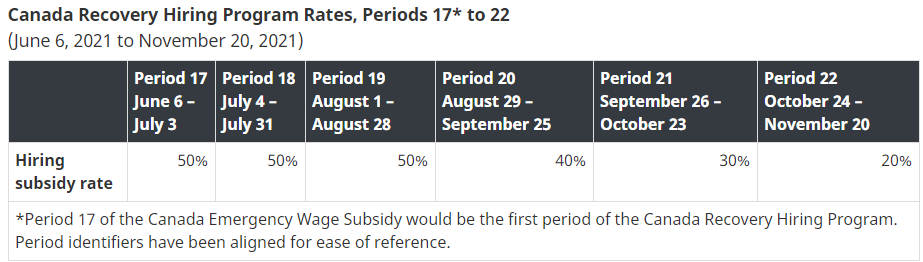

Provided that an eligible employer’s decline in revenues exceeds the revenue-decline threshold for a qualifying period (see Revenue-Decline Threshold below), its subsidy in that qualifying period would be equal to its incremental remuneration multiplied by the applicable hiring subsidy rate for that qualifying period. These hiring subsidy rates are shown in the table below.

To qualify for a hiring subsidy in a qualifying period, an eligible employer would have to have experienced a decline in revenues sufficient to qualify for the Canada Emergency Wage Subsidy in that qualifying period. For qualifying periods where the Canada Emergency Wage Subsidy is no longer in effect, an eligible employer would have to have experienced a decline in revenues of more than 10 per cent. As such, an eligible employer’s decline in revenues would have to be more than:

- 0 per cent, for the qualifying period between June 6, 2021 and July 3, 2021; and

- 10 per cent, for qualifying periods between July 4, 2021 and November 20, 2021.

An employer’s decline in revenues would be determined in the same manner as under the Canada Emergency Wage Subsidy. This method compares the employer’s revenues in a current calendar month with its revenues in the same calendar month, pre-pandemic. An employer can also elect to use an alternative approach, which compares the employer’s monthly revenues relative to the average of its January 2020 and February 2020 revenues. A deeming rule provides that an employer’s decline in revenues for any particular qualifying period is the greater of its decline in revenues for the particular qualifying period and the immediately preceding qualifying period.

Employers that had chosen to use the general approach for prior periods of the Canada Emergency Wage Subsidy would be required to continue to use that approach for the hiring subsidy. Similarly, employers that had chosen to use the alternative approach would be required to continue to use the alternative approach.

The reference periods set out in the table below would be used to determine an eligible employer’s decline in revenues for the qualifying periods from June 6, 2021 to November 20, 2021.

An application for the hiring subsidy for a qualifying period would be required to be made no later than 180 days after the end of the qualifying period.

Tax Treatment of COVID-19 Benefit Amounts

A range of taxable benefits have been made available to qualified individuals in response to the COVID-19 pandemic. Generally, if a benefit amount is repaid (for example, where an individual determines that they were not eligible for the benefit in question), this amount can only be deducted for income tax purposes in the year the repayment takes place. Therefore, if the repayment does not occur in the same year as the year of receipt of the benefit, an individual may owe tax in respect of the benefit for the year of receipt, while obtaining a deduction for the repayment amount in a future tax year.

Budget 2021 proposes to amend the Income Tax Act to allow individuals the option to claim a deduction in respect of the repayment of a COVID‑19 benefit amount in computing their income for the year in which the benefit amount was received rather than the year in which the repayment was made. This option would be available for benefit amounts repaid at any time before 2023.

For these purposes, COVID-19 benefits would include:

- Canada Emergency Response Benefits/Employment Insurance Emergency Response Benefits;

- Canada Emergency Student Benefits;

- Canada Recovery Benefits;

- Canada Recovery Sickness Benefits; and

- Canada Recovery Caregiving Benefits.

Individuals may only deduct benefit amounts once they have been repaid. An individual who makes a repayment, but who has already filed their income tax return for the year in which the benefit was received, would be able to request an adjustment to the return for that year.

Budget 2021 also proposes to amend the Income Tax Act to ensure that the COVID-19 benefit amounts noted above, and similar provincial or territorial benefit amounts, are included in the taxable income of those individuals who reside in Canada but are considered non-resident persons for income tax purposes. As a result, COVID-19 benefits received by these non-resident persons would be taxable in Canada in a manner generally similar to employment and business income earned in Canada.

UPDATE: April 21, 2021 – New Guidance on Amending a CEWS Claim After the Deadline

On April 21, 2021, CRA updated their guidance on amending applications after the applicable deadline has passed. Previously, CRA had stated that only downward adjustments (decreases to claims) would be permitted after a claim deadline has passed. However, the new guidance provides circumstances in which upward adjustments (increases to claims) would be permitted after a deadline has passed. These comments would apply to CERS claims as well. Below is the updated CRA guidance.

UNDER WHAT CIRCUMSTANCES WILL THE CRA ACCEPT MY LATE-FILED AMENDED APPLICATION FOR THE WAGE SUBSIDY?

The CRA will accept your late-filed amended wage subsidy application in certain circumstances.

If you determine that you received a wage subsidy amount in excess of what you are entitled to then you can submit an amended application to reduce your wage subsidy amount (referred to as a downward adjustment) at any time, even after the deadline for the particular claim period. You can submit your amended application using My Business Account or Represent a Client, or by calling Business Enquiries if you filed via the web application.

If, after the deadline for a claim period has passed, you determine that you might have been entitled to a higher wage subsidy amount than what you previously claimed for that claim period, contact the CRA Business Enquiries phone line to see if you are eligible to file an amended application to increase the wage subsidy amount (referred to as an upward adjustment) after the applicable deadline. If you are eligible, you can then submit your amended application using My Business Account or Represent a Client, or by obtaining further direction from Business Enquiries if you filed via the web application.

The circumstances in which the CRA may accept your amended application for review after the filing deadline include:

-

You made an error in filing your wage subsidy application prior to the filing deadline as a result of an arithmetic error, transposition error, or unintended omission of additional business activities or employment expenses;

-

You relied upon inaccurate information provided to you inadvertently by the CRA that directly affected your ability to file your amended wage subsidy application on time;

-

There was an identified outage of CRA secure portals that prevented you from filing the amended application prior to the applicable deadline; or

-

There was undue delay on the part of the CRA in processing an application or providing required guidance impacting the particular application.

Furthermore,

-

The upward adjustment request is not the result of professional advice the fee structure for which was dependent on the upward adjustment amount; and

-

The late-filed amended wage subsidy application request for an upward adjustment was made to the Business Enquiries phone line within 30 calendar days following the later of:

-

April 21, 2021; and

-

The applicable filing deadline.

-

In the case of late-filed amended wage subsidy application that is accepted for review through the secure portal, and after the review is either accepted, adjusted or denied, a Notice of Determination will be issued to you by the CRA. Please see Q #36 for an explanation of your recourse rights when you receive a Notice of Determination.

If your late-filed amended wage subsidy application was rejected for review by the CRA and not processed through the secure portal because you did not meet one of the above noted criteria, you may then seek a further review by submitting your request online by logging into My Business Account and selecting “Register a formal dispute”.

UNDER WHAT CIRCUMSTANCES WILL THE CRA ACCEPT MY LATE-FILED ORIGINAL APPLICATION FOR THE WAGE SUBSIDY?

The CRA will accept your late-filed wage subsidy original application only in exceptional circumstances. You must make every attempt to file your wage subsidy application on or before the deadline. If, however, you determine that you are entitled to a wage subsidy amount for a particular claim period for which you did not file an application on or before the applicable filing deadline, contact the CRA Business Enquiries phone line to see if you are eligible to file the application after the applicable deadline. If you are eligible, you can then submit your late-filed application using My Business Account, Represent a Client or via the web application.

The circumstances in which the CRA may accept your original application for review after the filing deadline include:

-

It is evident that you attempted to file your application before the applicable deadline but there was an identified outage of CRA secure portals that prevented you from filing the application prior to the applicable deadline;

-

It is evident that you attempted to file your application before the applicable deadline but your specific account was temporarily suspended or there was some other account limitation that prevented the filing of the application prior to the applicable deadline;

-

It is evident that you attempted to file your application before the applicable deadline, and there was undue delay on the part of the CRA in receiving and processing your wage subsidy application before the deadline; or

-

You relied upon inaccurate information provided to you inadvertently by the CRA that directly affected your ability to file your original wage subsidy application on time.

Furthermore,

-

The late filed wage subsidy claim is not the result of professional advice the fee structure for which was dependent on the claim amount; and

-

The late-filed wage subsidy application request was made to the Business Enquiries phone line within 30 calendar days following the later of:

-

April 21, 2021; and

-

The applicable filing deadline.

-

In the case of a late-filed wage subsidy application that is accepted for review through the secure portal, and after the review is either accepted, adjusted or denied, a Notice of Determination will be issued to you by the CRA. Please see Q #36 for an explanation of your recourse rights when you receive a Notice of Determination.

If your late-filed wage subsidy application was rejected for review by the CRA and not processed through the secure portal because you did not meet one of the above noted criteria then you may seek a further review by submitting your request online by logging into My Business Account and selecting “Register a formal dispute”.

UPDATE: April 15, 2021 – Revenu Québec announces tax filing deadline relief

Revenu Québec announced today they will show tolerance towards citizens who file their income tax return after the deadline.

The Minister of Finance, Revenu Quebec confirms that it will not impose any penalty or interest on citizens who file their income tax return or who pay their tax balance after the deadline of April 30, 2021, but no later than May 31, 2021. This new flexibility measure aims to simplify life for Quebecers who have been affected by the COVID-19 crisis .

The deadline for filing the income tax return and paying the balance of taxes for the 2020 tax year remains Friday, April 30, 2021, at 11:59 p.m. However, no late filing penalty will be applied to citizens who are not able to meet this deadline and no interest will be charged on a 2020 tax balance for the period from 1 st to May 31, 2021.

Penalties may apply for a tax return submitted after Monday, May 31, 2021. Interest will be charged to the outstanding balance of tax on May 31 and, as of 1 st June 2021, except for citizens who benefit one-year interest leave because they received financial support benefits related to COVID-19.

This flexibility measure responds to the exceptional health situation which continues to develop in Quebec. It aims to give Quebecers affected by the COVID-19 crisis more time to assume their fiscal responsibilities.

UPDATE: April 1, 2021 – CRA issues supplemental guidance on international tax issues

- extending the administrative relief in respect of individual income tax residence;

- clarifying some of the CRA’s views regarding the effect of the travel restrictions on the determination of a permanent establishment in Canada; and

- providing an outline of the Canadian income tax and compliance requirements of certain cross-border employees and providing some relief in respect of these requirements.

As with the guidance initially provided, this supplemental guidance is intended to assist taxpayers during this time of crisis and does not represent any interpretive position or intention to establish any broader policy by the CRA. Accordingly, the supplemental guidance below is applicable only for the periods described in the specific section.

For further details, refer to the supplemental guidance in section VII.

UPDATE: March 22, 2021 – CEBA application period extended

UPDATE: March 4, 2021 – CRA issues a notification regarding upcoming international guidance updates

The CRA is currently preparing a supplement to its Guidance on international income tax issues raised by the COVID-19 crisis. This supplement will include further guidance on individual income tax residency, permanent establishment, and cross-border employment income. If it is otherwise practical to do so, affected individuals may wish to delay filing their United States or Canadian income tax return until this supplemental guidance is provided, as there may be significant differences from previous year returns. These individuals may also wish to consider consulting a tax advisor to assist in this determination.

UPDATE: March 3, 2021 – Government of Canada announces wage and rent subsidy levels to remain unchanged to June

The Government of Canada announced its intention to extend the current rate structures for the Canada Emergency Wage Subsidy (CEWS), the Canada Emergency Rent Subsidy (CERS) and Lockdown Support subsidies from March 14 to June 5, 2021. Proposed program details for this period for the three measures are described below.

Maintaining the Current Rate Structures Until June 5, 2021

The rate structures for the wage subsidy for active employees, the rent subsidy, and Lockdown Support that are currently in place until March 13, 2021, would be extended for March 14 to June 5, 2021. This means that:

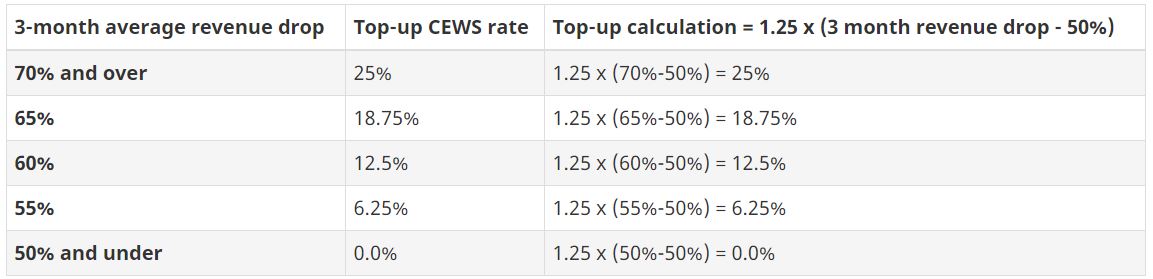

- The maximum combined wage subsidy rate for active employees would remain at 75 per cent (comprised of base wage subsidy rate of 40 per cent and the maximum top-up wage subsidy rate of 35 per cent).

- The maximum rent subsidy rate would remain at 65 per cent.

- Lockdown Support would remain at 25 per cent and continue to be provided in addition to the rent subsidy, providing eligible businesses with rent support of up to 90 per cent.

Support for Furloughed Employees

The wage subsidy for furloughed employees will remain aligned with benefits available under Employment Insurance (EI), that is, the weekly wage subsidy for a furloughed employee, from March 14 to June 5, 2021, would remain the same and continue to be the lesser of:

- the amount of eligible remuneration paid in respect of the week; and

- the greater of:

- $500; and

- 55 per cent of pre-crisis remuneration for the employee, up to a maximum subsidy amount of $595.

Employers would also continue to be entitled to claim under the wage subsidy their portion of contributions in respect of the Canada Pension Plan, EI, the Quebec Pension Plan and the Quebec Parental Insurance Plan for furloughed employees.

Revenue-decline Reference Periods

To ensure that the general approach continues to calculate an organization’s decline in revenues relative to a pre-pandemic month, the prior reference periods would be based on calendar months from 2019, effective as of the qualifying period from March 14 to April 10, 2021. The proposed reference periods are summarized in Table 1.

| Timing | Period 14 March 14 – April 10 |

Period 15 April 11 – May 8 |

Period 16 May 9 – June 5 |

|---|---|---|---|

| General approach | March 2021 over March 2019 or February 2021 over February 2020 | April 2021 over April 2019 or March 2021 over March 2019 | May 2021 over May 2019 or April 2021 over April 2019 |

| Alternative approach | March 2021 or February 2021 over average of January and February 2020 | April 2021 or March 2021 over average of January and February 2020 | May 2021 or April 2021 over average of January and February 2020 |

Employers that had chosen to use the general approach for prior periods would continue to use that approach. Similarly, employers that had chosen to use the alternative approach would continue to use the alternative approach.

Additional Baseline Remuneration Period

For the wage subsidy, an additional elective alternative baseline remuneration computation for March 14 to June 5, 2021 (Qualifying Periods 14 to 16), is proposed to ensure that the baseline remuneration comparator remains appropriate. In particular, an eligible employer would be allowed to elect, for qualifying periods from March 14 to June 5, 2021, to use the period of March 1, 2019 to June 30, 2019, or July 1 to December 31, 2019 (the current alternative period), to calculate baseline remuneration.

The Canada Revenue Agency will administer this measure on the basis of draft legislative proposals released with today’s announcement.

UPDATE: February 26, 2021 – What to expect when CRA reviews your claim

CRA will be reviewing claims to confirm the information submitted. CRA has issued the guidance (below) on what to expect when they review your CERS claim.

Keep your records

You must keep records showing information that supports your rent subsidy claim, such as your reduction in revenue and amounts for your eligible expenses. If you use the online calculator to calculate your subsidy amounts, print the results summary or save an electronic copy for your records. We may ask to see it when validating your claim. If you calculate your amounts another way, you must still save a record of how you came up with your amounts. If you have affiliated entities that are also applying for CERS for the same period you are, you must save a copy of the agreement you made about the percentage of the subsidy each business will claim.

Revenue drop – supporting documents

Other documents you may need to show to support your revenue drop include your:

- sales journal

- general ledger

- revenue amounts

- working paper calculations

Eligible expenses – supporting documents

Other documents you may need to show to support the expenses you claimed include your:

- rental or lease agreements

- property tax bills

- insurance documents

- mortgage documents

- provincial land title or property abstract, or

- title number, legal description, or other property identifying numbers such as

- parcel identifier number (PID)

- land identifier numerical codes (LINC)

- property identification number (PIN)

- mortgage registration number

- bank statements

- receipts or other proof of payment

Read more about records you should keep

Calls and letters from the CRA

The CRA may need to contact you by phone or mail to confirm details, ask for more information about your application, or notify you that your claim was not approved. Please make sure your contact information is current.

Calls from the CRA

CRA phone agents will never:

- use threatening or coercive language

- ask for full bank information, or

- ask for your full Social Insurance Number (SIN)

CRA phone agents should be able to provide you with information about your CERS application, as well as their name and phone number.

If you have concerns about a call you received regarding your CERS application, please call the CRA’s business enquiries line at 1-800-959-5525 and ask them to verify the name and number of the person that called you. You can also read more about how to recognize scams.

Letters from the CRA

You may receive a letter from the CRA if your application for CERS was not accepted, or if your claim was modified after we review the information.

Consequences of fraudulent claims

If you do not meet the CERS eligibility requirements for a period, you will be required to repay any amounts you received for that period. Canadians can also report suspected CERS misuse through the CRA’s Leads program. Penalties may apply in cases of fraudulent claims, including fines or even imprisonment. If you artificially reduce your revenue or increase your expenses for the purpose of claiming the rent subsidy, you will be required to repay any subsidy amounts you received, plus a penalty equal to 25% of the total value.

UPDATE: February 26, 2021 – CERS expansion to lockdown support for eligible property owners with non-arm’s length tenants

On February 26, 2021 the CRA provided new guidance on additional lockdown support availability for eligible property owners with tenants not at arm’s length:

The lockdown support portion of the CERS may be available to eligible property owners, if:

-

their tenant is not at arm’s length

-

the tenant uses the qualifying property in the course of its regular activities

-

that property is subject to a lockdown

-

the tenant must shut their doors or significantly restrict their activities under a public health order, and

-

the property owner meets all other applicable conditions required to qualify for lockdown support

UPDATE: February 19, 2021 – Government of Canada proposes increase to number of weeks for recovery benefits and EI regular benefits

The Government of Canada announced its intent to introduce regulatory and legislative amendments to increase the number of weeks of benefits available for the Canada Recovery Benefit (CRB), the Canada Recovery Sickness Benefit (CRSB), the Canada Recovery Caregiving Benefit (CRCB) and Employment Insurance (EI) regular benefits.

The proposed changes are as follows:

- increase the number of weeks available under the Canada Recovery Benefit (CRB) and the Canada Recovery Caregiving Benefit (CRCB) by 12 weeks extending the maximum duration of the benefits through regulation from 26 weeks to up to 38 weeks;

- increase the number of weeks available under the Canada Recovery Sickness Benefit (CRSB) through regulation from the current 2 weeks to 4 weeks; and

- increase the number of weeks of EI regular benefits available by up to 24 weeks to a maximum of 50 weeks through legislation, for claims that are made between September 27, 2020 and September 25, 2021.

- self-employed workers who have opted in to the EI program to access special benefits would be able to use a 2020 earnings threshold of $5,000, compared to the previous threshold of $7,555. This change would be retroactive to claims established as of January 3, 2021 and would apply until September 25, 2021.

To ensure employees in the federally regulated private sector can access the proposed additional weeks of CRCB and CRSB without the risk of losing their jobs, the maximum length of the leave related to COVID-19 under the Canada Labour Code would also be extended. Provincial and territorial governments will determine whether they need to amend their job-protected leaves in order to facilitate employees’ access to the proposed additional weeks of CRSB and CRCB benefits.

UPDATE: February 16, 2021 – Applications for the Canada United Small Business Relief Fund have been reopened.

On October 20, 2020, we reported on the introduction of a new relief grant for small businesses, the Canada United Small Business Relief Fund. The Canada United Small Business Relief Fund (CUSBRF) was established to help small businesses offset the cost of expenses to open safely or adopt digital technologies to move more of their business online. Over $14 Million has been contributed by the Federal Government, RBC, and Canada United partners to support recovery efforts due to COVID-19 and relief has already been provided to over 2,000 small businesses across the country.

The CUSBRF is now able to extend relief grants to more small businesses and restart accepting grant applications from small businesses across all provinces for expenses incurred no earlier than March 15, 2020. Applications are open for all provinces and territories as of February 16th, 2021.

Below is a reproduction of our October 20 article.

The federal government is investing $12 million into the Canada United Small Business Relief Fund (CUSBRF), to support small businesses through the coronavirus pandemic. The CUSBRF provides eligible small businesses with relief grants of up to $5,000, to be used for pandemic recovery efforts. The grant provides a reimbursement of costs incurred in order to allow a safe reopening and the adoption of digital technologies, in relation to COVID-19.

The CUSBRF is part of the #CanadaUnited nationwide campaign, which encourages Canadians to support local businesses by buying, dining and shopping local. The CUSBRF will be managed by the Ontario Chamber of Commerce, on behalf of the national Chamber network in support of other chambers and partners. Applicants for the relief grant do not need to be members of the Ontario Chamber of Commerce (OCC).

Qualifying entities include small to medium-sized (SME) companies from any sector and from all regions of Canada who meet the eligibility criteria. Both for-profit and not-for-profit organizations are eligible to apply, although government organizations, municipalities, charities and the chamber of commerce network are not eligible. Considerations will be made to ensure the fund is distributed broadly, to all Canadian regions. Priority applicants for consideration will include businesses owned by Indigenous Peoples, women, visible minorities, LGBTQ2+ and persons with disabilities.

ELIGIBLE EXPENSES

Expenses eligible for reimbursement fall under the following 3 categories:

- Purchasing personal protective equipment such as masks, face shields and latex gloves

- Renovating physical spaces to adhere to local, provincial or federal reopening guidelines

- Developing or improving e-commerce capabilities for your business (including enhancements of websites)

For more information on eligible and ineligible expenses, click here.

Eligible expenses directly related to the above categories are permitted provided that purchases were made no earlier than March 15, 2020. All eligible expenses must be incremental and a direct result of adjusting operations for pandemic safety guidelines. Normal or usual ongoing business costs are not eligible.

ELIGIBILITY CRITERIA

Eligibility Criteria Include:

- Must be incorporated, or operating as a sole proprietor/partnership in Canada, as of March 1, 2020

- Must have less than 75 employees

- Annual sales are at minimum $150,000 and not more than $3,000,000

- Must have $1,000,000 of commercial general liability insurance

- Must not be receiving other contributions from public funds toward the specific activities contained in the application

- Must be in full compliance with all applicable government laws, rules, regulations and guidelines

- Must be in operation after September 1, 2020

APPLICATION

The new application window will open on Monday, October 26, 2020. (New window opened February 16, 2021). Applications can be submitted at the following website, by clicking on the link related to the province in which your business is located. The application can be accessed by clicking on the application link located on your participating local or provincial Chamber of Commerce site. Only one application per ownership group can be submitted.

Applicants will be required to describe the reason they are applying to the program and explain the impact COVID-19 has had on operations, including the possible economic hardship, temporary closure, etc. Further, applicants must attach all necessary receipts and invoices, accompanied with proof of payment to their application. Applicants must also submit the company’s sales tax (GST/HST) registration document or a recent sales tax (GST/HST) filing and one of the following documents:

-

- Proof of business registration

- Business license

- Articles of incorporation or letters patent

- For partnerships: articles of incorporation or letters patent for each corporate partner

These documents must show official stamp, logo or other official identifying details from the issuing agency.

For more information, refer to the program guidelines and the pre-application check-list.

UPDATE: February 9, 2021 – Government of Canada announces interest relief on 2020 income tax debt due to COVID-19 related income support

The Government of Canada announced that it will provide targeted interest relief to Canadians who received COVID-related income support benefits. Once individuals have filed their 2020 income tax and benefit return, they will not be required to pay interest on any outstanding income tax debt for the 2020 tax year until April 30, 2022. This will give Canadians more time and flexibility to pay if they have an amount owing.

To qualify for targeted interest relief, individuals must have had a total taxable income of $75,000 or less in 2020 and have received income support in 2020 through one or more of the following COVID-19 measures:

- the Canada Emergency Response Benefit (CERB);

- the Canada Emergency Student Benefit (CESB);

- the Canada Recovery Benefit (CRB);

- the Canada Recovery Caregiving Benefit (CRCB);

- the Canada Recovery Sickness Benefit (CRSB);

- Employment Insurance benefits; or

- similar provincial emergency benefits.

The Canada Revenue Agency (CRA) will automatically apply the interest relief measure for individuals who meet these criteria.

Additionally, any CRA-administered credits and benefits normally paid monthly or quarterly, such as the Canada Child Benefit and the goods and services tax/harmonized sales tax credit will not be applied to reduce individuals’ tax debt owing for the 2020 tax year. Canadians are strongly encouraged to file their tax returns by the filing deadline to ensure that their benefit payments continue without interruption.

UPDATE: February 9, 2021 – Government of Canada addresses CERB repayments for self-employed individuals

The Government of Canada announced that self-employed individuals who applied for the Canada Emergency Response Benefit (CERB) and would have qualified based on their gross income will not be required to repay the benefit, provided they also met all other eligibility requirements. The same approach will apply whether the individual applied through the Canada Revenue Agency or Service Canada.

This means that, self-employed individuals whose net self-employment income was less than $5,000 and who applied for the CERB will not be required to repay the CERB, as long as their gross self-employment income was at least $5,000 and they met all other eligibility criteria.

Some self-employed individuals whose net self-employment income was less than $5,000 may have already voluntarily repaid the CERB. The CRA and Service Canada will return any repaid amounts to these individuals. Additional details will be available in the coming weeks.

UPDATE January 26, 2021 – Highly Affected Sectors Credit Availability Program launched.

On January 26, 2021, the Government announced the details of the Highly Affected Sectors Credit Availability Program (HASCAP).

Through HASCAP, the Business Development Bank of Canada (BDC) will work with participating Canadian financial institutions to offer government-guaranteed, low-interest loans of up to $1 million. Hard-hit businesses, like a chain of hotels or restaurants with multiple locations under one related entity, could be eligible for up to $6.25 million.

HASCAP is available to businesses across the country, in all sectors, that have been hit hard by the pandemic. This includes restaurants, businesses in the tourism and hospitality sectors, and those that rely on in-person service.

To be eligible, Canadian-based businesses need to show they have:

-

a year-over-year revenue decline of at least 50% in three months, within the eight months prior to their application;

-

previously applied for and received payments from either CEWS or CERS; and

-

been financially stable and viable pre-COVID

Loan funds must be used to continue or resume operations and cannot be used to pay or refinance existing debt.

Terms of loans include low (4%) interest with a repayment term of up to 10 years and up to a 12 month postponement of principal payments. The HASCAP guarantee is available until June 30, 2021.

Eligible businesses can start applying as early as February 1 at principal financial institutions and more widely by February 15. Interested businesses should contact their primary lender to get more information and to apply. More information is available at www.bdc.ca/hascap.

UPDATE January 11, 2021 – Non-essential international travel will affect access to the Canada Recovery Benefits.

On January 11, 2021, the Government of Canada announced that they will propose legislation to change the eligibility rules so that, retroactive to January 3, 2021, all international travelers who need to quarantine upon return to Canada will not be eligible to receive support from the Canada Recovery Sickness Benefit, the Canada Recovery Caregiving Benefit and the Canada Recovery Benefit for the period of their mandatory quarantine. Individuals who are exempt from the mandatory quarantine requirements under the Quarantine Act will be eligible to apply following their return to the country.

Once they have served the mandatory quarantine period, individuals would be able to claim the recovery benefits for subsequent periods if they meet the eligibility criteria.

The Canada Revenue Agency (CRA) will update the application process for the three recovery benefits on Monday, January 11. For claims covering a period beginning on or after January 3, 2021, applicants will need to indicate whether they were self-isolating or in quarantine due to international travel. Over the coming weeks, the CRA will delay processing claims for individuals who are self-isolating or in quarantine because of international travel until the legislative process is complete to ensure those who receive the benefit meet the latest eligibility criteria.

UPDATE January 6, 2021 – CEWS and CERS information released for periods 11-13.

On January 6, 2021, additional information was released relating to periods 11-13 in respect of CEWS, and the corresponding periods for CERS, as follows:

- the maximum CEWS claim will be 75% of applicable remuneration. The maximum base subsidy rate remains at 40% and maximum top-up subsidy rate is 35%

- the maximum base CERS claim will be 65% of applicable expenses. The top-up for CERS lock-down support remains at 25%

- the reference periods to be used for determining period 11 claims are the same as for period 10, which use December or November revenues

- the maximum subsidy amount for employees on leave with pay is $595

UPDATE January 3, 2021 – Canada Summer Jobs 2021 program applications open.

Applications are now open for the Canada Summer Jobs (CSJ) 2021 program. Applications must be submitted by January 29, 2021.

The CSJ program provides wage subsidies to employers from not-for-profit organizations, the public sector and private sector organizations with 50 or fewer full-time employees, to create quality summer work experiences for young people aged 15 to 30 years. Funded employers are not restricted to hiring students — all youth aged 15 to 30 years may be eligible participants.

The CSJ 2021 program will continue to offer the temporary flexibilities in response to the COVID-19 pandemic, previously introduced for the 2020 CSJ program. The following temporary flexibilities will be in place for CSJ 2021:

- Wage subsidies: Funded public and private sector employers will be eligible to receive a wage subsidy reimbursement of up to 75% of the provincial or territorial minimum hourly wage. Under regular rules, private and public sector employers are only eligible to receive up to 50% of the provincial or territorial minimum wage.

- Part-time employment: All funded employers may offer part-time placements (for example, fewer than 30 hours per week). Under regular rules, all CSJ-funded employment has to be full time (a minimum of 30 hours per week).

- Employment period: All funded employers may offer job placements between April 26, 2021 and February 26, 2022. Under regular rules, all CSJ-funded positions have to be completed during the summer months.

- Changes to project and job activities: All funded employers may amend project and job activities if the proposed project is impacted by COVID-19 restrictions after an agreement is signed. In such cases, the employer should contact Service Canada to discuss potential amendments. All changes must be approved by Service Canada.

Applications can be submitted using an online fillable application, through Grants and Contributions Online Services (GCOS), in person, or by mail. For more information on the CSJ program, visit their website.

UPDATE December 21, 2020 – Ontario Small Business Support Grant announced amidst news of December 26th province-wide lockdown.

The Ontario government is imposing a Provincewide Shutdown which will go into effect as of Saturday, December 26, 2020, at 12:01 a.m. The government also announced that it is providing grants of up to $20,000 to small businesses impacted by new public health measures. In January 2021, applications will open for the new Ontario Small Business Support Grant, which will help small businesses that are required to close or significantly restrict services under this new Provincewide Shutdown.

Grant amount

Starting at $10,000 for all eligible businesses, the grant will provide businesses with dollar for dollar funding to a maximum of $20,000 to help cover decreased revenue expected as a result of the Provincewide Shutdown. The business must demonstrate they experienced a revenue decline of at least 20 per cent when comparing monthly revenue in April 2019 and April 2020. This time period was selected because it reflects the impact of the public health measures in spring 2020, and as such provides a representation of the possible impact of these latest measures on small businesses.

Businesses will be able to use the support in whatever way makes the most sense for them. For example, some businesses will use the support to pay employee wages, while others will need support maintaining their inventory.

Eligibility

To receive the grant, a small business must:

- Be required to close or restrict services subject to the Provincewide Shutdown effective 12:01 a.m. on December 26

- Have fewer than 100 employees at the enterprise level

- Have experienced a minimum of 20 per cent revenue decline comparing April 2020 to April 2019 revenues

Examples of eligible small businesses include: restaurants and bars, fitness centres and gyms, conference and convention centres, personal care services relating to the hair or body (with exception of oxygen bars), in person teaching and instruction, retail required to close for in-person shopping, shopping malls, personal services, photography services, outdoor sports and recreation facilities/amenities, safety, medical and assistive devices retail, rental and leasing services, lawn care and landscaping services, domestic services, vehicle and equipment repair services, veterinary services, cell phone and computer providers & repairs, and media industries including film and television production. For more examples of eligible businesses, click here.

Businesses that are not eligible include those that were already required to close prior to the introduction of modified Stage 2 measures, and essential business permitted to operate with capacity restrictions (e.g., discount and big box stores selling groceries, supermarkets, grocery stores, convenience stores, pharmacies, and beer, wine and liquor stores).

For small businesses not in operation in April 2019 or April 2020, eligibility criteria will be announced in January 2021.

Further details about the grant, including how to apply, will be available in January 2021.

UPDATE December 21, 2020 – Government announces the 2021 automobile deduction limits and expense benefit rates for businesses and temporary adjustments due to COVID-19.

Today, the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit rates that will apply in 2021.

Most of the limits and rates that applied in 2020 will continue to apply in 2021, with one change taking effect as of January 1, 2021:

- The general prescribed rate used to determine the taxable benefit of employees relating to the personal portion of automobile expenses paid by their employers will be decreased by one cent to 27 cents per kilometre. For people who are employed principally in selling or leasing automobiles, the rate used to determine the employee’s taxable benefit will be decreased by one cent to 24 cents per kilometre.

The following limits from 2020 will remain in place for 2021:

- The limit on the deduction of tax-exempt allowances paid by employers to employees who use their personal vehicle for business purposes will remain at 59 cents per kilometre for the first 5,000 kilometres driven, and 53 cents per kilometre for each additional kilometre. For the Northwest Territories, Nunavut and Yukon the allowance is 4 cents higher, and will remain at 63 cents per kilometre for the first 5,000 kilometres driven, and 57 cents per kilometre for each additional kilometre.

- The ceiling for capital cost allowances (CCA) for passenger vehicles will remain at $30,000, before tax, for non zero-emission passenger vehicles, and at $55,000, before tax, for eligible zero-emission passenger vehicles. These ceilings restrict the cost of a vehicle on which CCA may be claimed for business purposes.

- The maximum allowable interest deduction for new automobile loans will remain at $300 per month.

- The limit on deductible leasing costs will remain at $800 per month, before tax for new leases entered into. For automobiles valued over $30,000, a separate restriction will continue to prorate deductible lease costs.

temporary adjustment to standby charge

In light of the impact COVID-19 lockdowns and public health measures have had on how employees use their employer-provided vehicles, the government is also proposing temporary adjustments to the automobile standby charge. For the 2020 and 2021 taxation year, it is proposed that employees be allowed to use their 2019 automobile usage to determine eligibility for the reduced standby charge. Only employees with an automobile provided by the same employer as in 2019 would be eligible for this option. For more information, please refer to the related backgrounder.

UPDATE December 15, 2020 – Details regarding claiming home office expenses deductions on personal tax returns for the 2020 tax year were announced.

The Minister of National Revenue announced the highly-anticipated details regarding home office expenses deductions, which we have summarized.

The Canada Revenue Agency (CRA) has made the home office expenses deduction available to more Canadians and simplified the way in which employees can claim these expenses on their personal income tax returns for the 2020 tax year. Employees who have worked from home due to the pandemic, for more than 50% of the time over a period of a least four consecutive weeks in 2020 will now be eligible to claim the home office expenses deduction for 2020. The use of a shorter qualifying period will ensure that more employees can claim the deduction, than would otherwise have been possible under longstanding practice. To learn more about home office expenses deductions see our article, New Home Office Expenses Guidance Released.

UPDATE December 4, 2020 – The Canada Emergency Business Account program has been expanded.

As of December 4, 2020, Canada Emergency Business Account (CEBA) loans for eligible businesses have increased from $40,000 to $60,000. Applicants who have received the $40,000 CEBA loan may apply for the $20,000 expansion, which provides eligible businesses with an additional $20,000 in financing. All applicants have until March 31, 2021 to apply for the $60,000 CEBA loan or the $20,000 expansion.

Applicants with a $40,000 CEBA loan may apply for the $20,000 expansion by contacting the financial institution that provided the original CEBA loan. You will need to submit a new application and attestation to the financial institution that provided you with your original CEBA loan. You will not need to resubmit your original application, or re-upload expense documents. If you have already repaid your original CEBA loan, you may apply for the $20,000 expansion at the financial institution that provided you with your original CEBA loan. Once a financial institution begins to offer the $60,000 loan, you may no longer apply for solely the $40,000 loan.

Once you have applied at your financial institution, uploaded all necessary supporting documents (if applicable) and if pre-funding eligibility validation is successful, you should expect to receive funding within 10-15 business days.

CEBA repayment terms apply to all CEBA loans (original loan and expansion loan).

Terms of Forgiveness

- If you borrowed $40,000 or less: Repaying the outstanding balance of the loan (other than the amount available to be forgiven) on or before December 31, 2022 will result in loan forgiveness of 25 percent (up to $10,000).

- If you borrowed more than $40,000 and up to $60,000: If you received a $40,000 loan and subsequently received the $20,000 expansion, the terms of your forgiveness have changed as follows: Repaying the outstanding balance of the loan (other than the amount available to be forgiven) on or before December 31, 2022 will result in a single tranche of loan forgiveness up to $20,000 based on a blended rate of 25 percent on the first $40,000 plus 50 percent on amounts above $40,000 and up to $60,000.

- If you fully repaid your original $40,000 loan, claimed forgiveness and thereafter received the $20,000 expansion: Repaying the outstanding balance of the $20,000 expansion (other than the amount available to be forgiven) on or before December 31, 2022 will result in loan forgiveness of 50 percent (up to $10,000).

For more information, visit our Covid-19 Hub and the CEBA website.

UPDATE November 30, 2020 – The Minister of Finance and Deputy Prime Minister Chrystia Freeland delivered the 2020 Fall Economic Statement.

We have outlined select highlights related to the economic support for individuals and businesses in our article, Fall Economic Statement 2020.

To read the article, click here.

UPDATE November 20, 2020 – The application for the new Canada Emergency Rent Subsidy program will be available on November 23.

Today, the Government of Canada announced that the application for the new Canada Emergency Rent Subsidy (CERS) will be accessible through CRA on November 23, 2020.

Measures adopted as part of Bill C-9, which received Royal Assent on November 19, 2020, include the following:

- The new CERS program, which provides tenants and property owners assistance with rent and mortgage interest payments until June 2021. The new program is set to support charities, businesses and non-profit organizations that have experienced a drop in revenue by providing support up to a maximum of 65% of eligible expenses until December 19, 2020. Claims can be made retroactively to September 27, 2020.

- The new Lockdown Support, which will provide an additional 25% through CERS to qualifying organizations subject to lockdown procedures, should they be required to shut their doors or restrict their activities significantly under a public health order issued under the laws of Canada, a province or territory (including orders made by a municipality or regional health authority under one of those laws).

- The extension of the Canada Emergency Wage Subsidy (CEWS) until June 2021. CEWS will remain at the current rate of up to 65% of eligible wages until December 19, 2020.

The new CERS attestation form (RC665) is now available. To add, the government also reaffirms its intention to formalize rent payable as an eligible expense for purposes of the CERS, as of September 27, 2020. Qualifying organizations will be able to take advantage of the rent subsidy on this basis once the application portal is launched.

For more information on the new CERS, visit our COVID-19 Hub.

UPDATE November 3, 2020 – New measures to help Canadian small businesses access global markets amid COVID-19 are announced.

The government has announced new actions to help Canadian businesses grow while navigating the challenges of the COVID-19 pandemic in the global marketplace.

The Government of Canada launched the CanExport SMEs program, delivered through the Trade Commissioner Service in 2016. This program has helped small business owners and entrepreneurs break into new international markets with funding of up to $75,000 to cover travel costs and other expenses.

With international travel restricted due to COVID-19, the CanExport SMEs program is pivoting to help small businesses:

- develop and expand their e-commerce presence by covering partial costs associated with online sales platforms and digital strategy consulting, as well as advertising and search engine optimization

- attend virtual trade shows and other business-to-business events

- navigate new COVID-19-related trade barriers by helping pay for new international market certifications and requirements

These new measures will also provide dedicated support for Indigenous and women-owned small businesses, which have been disproportionately impacted by the COVID-19 crisis.

This new support will help small businesses in the coming months explore new opportunities to sell their world-class Canadian products and services in the international marketplace, grow their businesses and create good jobs for Canadians. Small business owners and entrepreneurs are encouraged to apply for CanExport SMEs program funding. Click here to view application guidelines.

UPDATE November 3, 2020 – The Ontario government is providing property tax and energy cost rebates to eligible businesses.

The Ontario government is providing property tax and energy cost rebates to eligible businesses required to significantly restrict their services or close their doors as a result of provincial public health restrictions. Through Ontario’s Property Tax and Energy Cost Rebates program, the government is building on its collaboration with federal partners and dedicating $300 million to ensure eligible businesses receive the financial help they require.

The rebates will include municipal and education property taxes and energy costs, including electricity and natural gas (or where natural gas is not available, propane and heating oil). The funding will cover the entire length of time that regionally targeted public health restrictions are in place. Property tax rebates will be net of any federal support in respect of property taxes provided through the new Canada Emergency Rent Subsidy (CERS), so as to cover costs beyond those already covered by CERS. Details about applying for CERS are expected to be forthcoming from the Government of Canada.

Eligibility Criteria

Eligible businesses must be located in areas subject to modified Stage 2 public health restrictions (Ottawa, Peel, Toronto, and York Region), or going forward, in areas that fall under ‘Control’ or ‘Lockdown’ categories.

Types of businesses that are eligible for support include:

- restaurants and bars

- gyms, facilities for indoor sports and recreational fitness activities

- performing arts and cinemas

- bingo halls, gaming establishments, casinos, conference centres and convention centres

- community centres, multi-purpose facilities, and museums

- personal care services (with exception of oxygen bars)

- racing venues

- meeting or event space

- in-person teaching and instruction

Application

Beginning November 16, eligible businesses will be able to apply for temporary property tax and energy cost rebates directly to the province through a single, online application portal. Many businesses can expect to receive their rebate payments within a few weeks of finalizing and submitting their application.

You will need to submit proof of costs and information related to your business’ revenue decline, that is consistent with the information you submit as part of your CERS application.

For property tax rebates, this includes your property tax bills (or proof of costs associated with property taxes).

For energy cost rebates, this includes a digital copy of the first energy bill you received (including electricity, natural gas, propane or other) on or after the day Stage 2 restrictions were put in place in your region. You can also submit other energy bills if your business is heated by propane or heating oil.

For questions about property tax and energy bill rebates, please contact the Stop the Spread Business Information Line at 1-888-444-3659

UPDATE October 26, 2020 – The Canada Emergency Business Account will be available to businesses operating out of a non-business banking account.

The government announced that the Canada Emergency Business Account (CEBA) will be available to businesses that have been operating out of a non-business banking account.

To be eligible, businesses must have been operating as a business as of March 1, 2020, must successfully open a business account at a Canadian financial institution that is participating in CEBA and meet the other existing CEBA eligibility criteria. The deadline to apply for CEBA is December 31, 2020.

UPDATE October 26, 2020 – The government extends the deadline to apply for the Disability Tax Credit.

The deadline to apply for the Disability Tax Credit (DTC) to receive the one-time payment has been extended from September 25, 2020, to December 31, 2020. This non-taxable and non-reportable payment of up to $600 is intended to support Canadians with disabilities and help them with additional expenses incurred during the pandemic.

The one-time payment will help persons with disabilities with the following expenses:

- expenses related to hiring personal support workers and accessing other disability supports;

- paying for increased costs for medical supplies and medication;

- purchasing personal protective equipment;

- higher costs associated with physical distancing and working from home; anincreased use of transportation and home delivery services to obtain groceries and prescriptions.

Most eligible Canadians will begin to receive their payments on October 30, 2020, through direct deposit and by mail, using information collected from existing government programs. These are individuals who had an existing valid Disability Tax Credit (DTC) certificate at the time the information for the one-time payment was collected (September 2020), or were a beneficiary as at July 1, 2020 of:

- Canada Pension Plan Disability; and/or

- Quebec Pension Plan Disability Pension; and/or

- one of the disability supports provided by Veterans Affairs Canada (VAC).