UPDATE APRIL 21, 2020: Additional information on how to calculate the Canada Emergency Wage Subsidy has been issued.

A revised CEWS website and new calculator is now available to help businesses determine the subsidy amount to expect from the CEWS program. If you intend to apply for the CEWS, you are advised to follow the guidance in this calculator.

UPDATE APRIL 11, 2020: The Department of Finance issued additional information on the Canada Emergency Wage Subsidy through it’s Backgrounder.

On April 11, the CEWS legislation was passed. The final legislation included some change to the earlier announced provisions as follows:

- In order to provide certainty to employers, once an employer is found eligible for a specific period, the employer automatically qualifies for the next period.

- Special rules for corporate groups were introduced.

- Clarification as to the interaction with the 10% wage subsidy and the work-sharing EI benefit: amounts received under these programs will reduce the CEWS.

- Clarification as to the interaction with the Canada Emergency Response Benefit: No subsidy is available for an individual who is without remuneration by the eligible entity in respect of 14 or more consecutive days in the qualifying period. The Government will consider implementing an approach to limit duplication.

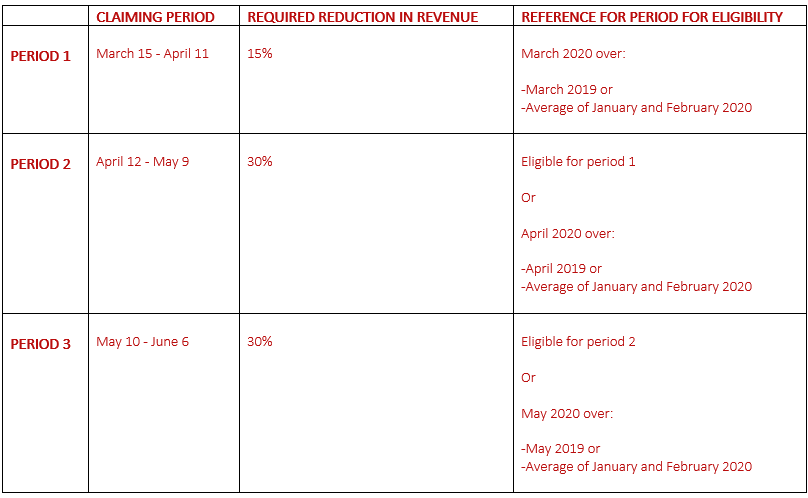

To summarize, the table below outlines each claiming period, the required reduction in revenue and the reference period for eligibility:

UPDATE APRIL 8, 2020: The Department of Finance issued additional information on the Canada Emergency Wage Subsidy through it’s Backgrounder.

On April 8, Finance Minister Bill Morneau provided further details on the Canadian Emergency Wage Subsidy (CEWS) and a new refund for CEWS eligible employers.

Canada Emergency Wage Subsidy Eligibility

The eligibility criteria for businesses to access the Canada Emergency Wage Subsidy (CEWS) were expanded to address the realities faced by the not-for-profit sector, high growth companies and new businesses. The Government proposed the following additional flexibility with respect to the revenue test:

- To measure their revenue loss, all employers have the flexibility to compare their revenue of March, April and May 2020 to:

-that of the same month of 2019; or

-an average of their revenue earned in January and February 2020. - For March, a reduction to the 30-per-cent benchmark to 15 per cent.

- Employers are allowed to measure revenues either on the basis of:

-accrual accounting (as they are earned); or

-cash accounting (as they are received). - Registered charities and non-profit organizations are allowed to choose to include or exclude government funding in their revenues for the purpose of applying the revenue reduction test.

Where an option is provided for revenue loss calculation / measurement methods, the selected method would be required to be used for the entire duration of the program. Special rules would also be provided to address issues for corporate groups, non-arm’s length entities and joint ventures.

Refund of Certain Payroll Contributions

UPDATE APRIL 2, 2020: The Department of Finance issued additional information on the Canada Emergency Wage Subsidy through it’s Backgrounder.

The subsidy amount for a given employee on eligible remuneration paid between March 15 and June 6, 2020 would be the greater of:

- 75 per cent of the amount of remuneration paid, up to a maximum benefit of $847 per week; and

- the amount of remuneration paid, up to a maximum benefit of $847 per week or 75 per cent of the employee’s pre-crisis weekly remuneration, whichever is less.

The pre-crisis remuneration (later referred to as the ‘baseline remuneration’) for a given employee is based on the average weekly remuneration paid between January 1 and March 15 inclusively, excluding any seven-day periods in respect of which the employee did not receive remuneration. Employers are also eligible for a subsidy of up to 75% of salaries and wages paid to new employees.

A special rule applies to employees that do not deal at arm’s length with the employer. The subsidy amount for such employees is limited to the eligible remuneration paid in any pay period between March 15 and June 6, 2020, up to a maximum benefit of the lesser of $847 per week and 75% of the employee’s pre-crisis weekly remuneration. The subsidy is only available in respect of non-arm’s length employees employed prior to March 15, 2020.

ORIGINAL ARTICLE – APRIL 1

On April 1, 2020, Finance Minister Bill Morneau discussed additional details pertaining to the Canada Emergency Wage Subsidy (CEWS) program. The CEWS is the largest economic program in Canada’s history, estimated to cost $71 billion. Morneau presented the broad strokes of the program, with further details expected to come in the days ahead. Here’s what we know now:

What is the CEWS?

The CEWS is a wage subsidy which will cover 75 per cent of the first $58,700 of an employee’s salary, up to a maximum of $847 per week. It is available for qualifying employers, for up to 3 months, retroactive to March 15, 2020.

Who Qualifies for the CEWS?

The CEWS will be available to Canadian non-publicly funded companies, charities, not for profits, partnerships and individuals who see a 30 per cent or more decline in their gross revenues since this time last year. Qualifying employers will have to demonstrate this drop by comparing revenues for the same month last year, for the months of March, April, and May. Employers will need to reapply each month. Employers will have to demonstrate the pre-crisis income of their workers and that they have paid their workers. See updates to this above.

Employers will be required to attest that they are doing everything they can to pay the remaining 25% of their workers income. Recognizing this is not always possible, Morneau indicated that the system will be flexible. The number of employees will not affect eligibility.

What About Situations Where There is No Sales History?

For situations where an employer is not able to show a revenue decline compared to the same month in the prior year, due to circumstances such as startups, new businesses, or businesses with significant revenue lags, the guidance is not yet clear. Morneau indicated they are working on releasing further administrative details regarding these types of situations, suggesting they may allow use of previous months revenues as a comparison. See updates to this above.

What about the 10% Wage Subsidy announced earlier?

The 75 per cent CEWS does not replace the previously announced 10 per cent wage subsidy program. The 10 per cent wage subsidy will still be available to employers that don’t qualify for the 75 per cent wage subsidy. See updates to this above.

How will the CEWS be administered?

Employers will be able to apply online through a Canada Revenue Agency (CRA) portal which is expected to be launched within the next 3-6 weeks. The CEWS will be provided in the form of a direct payment to qualifying employers. The CEWS will not be administered through a reduction of payroll remittances, as is being done for the 10 per cent wage subsidy program.

Employers are advised to get themselves set up on a direct deposit system with the CRA in order to receive their subsidy more quickly.

When will the CEWS be available?

CEWS funds are expected to be available in approximately 6 weeks.

The CEWS program is intended to help businesses keep and return workers to payroll. Morneau noted there will be severe consequences and penalties for anyone who seeks to use the funds fraudulently.

The CEWS program is aimed at protecting Canadian jobs, and is one part of a three pronged approach, which includes the Canada Emergency Response Benefit (CERB), aimed at helping Canadians who have lost their jobs, and the Canada Emergency Business Account (CEBA), aimed at helping businesses with liquidity through access to credit.

More details are expected to follow soon.

This article has been written in general terms to provide broad guidance only. It should not be relied upon to cover specific situations and you should not act upon the information contained herein without obtaining specific professional advice. Please contact our office to discuss this information in the context of your specific circumstances. We accept no responsibility for any loss or damage resulting from your reliance on the information in this article.

Author

Partner