Input Tax Credit Recapture and Input Tax Refunds Restrictions

In the past, large businesses, defined as organizations that exceed $10 million in taxable and zero-rated revenues during their fiscal year (including revenue from related entities), have been required to repay a portion of their input tax credits (ITC) claimed on the provincial part of the harmonized sales tax (HST) paid or payable on specified services or property in Ontario. In Quebec, such businesses were subject to a restriction on the related input tax refunds (ITR). Failure to restrict ITR’s or recapture ITC’s can lead to penalties which could be applied to both over/under reporting of RITC’s or restricted ITR’s.

Specified services and property for which these recaptured input tax credit (RITC) requirements and ITR restrictions applied included energy, telecommunications, meals and entertainment and specified motor vehicles.

New rules no longer require large businesses to repay ITCs for the provincial component of the Ontario HST that became payable on or after July 1, 2018. This marks the completion of a three-year phase out period of the RITC. However, reporting requirements with respect to RITCs will continue until June 30, 2021. Similar rules in PEI and Quebec are also being phased out. Quebec phase-out of its restrictions is to begin January 1, 2019, as explained further below. PEI phase out, to begin April 1, 2019, is not covered in this article (for more information, contact us).

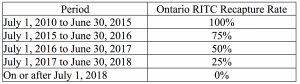

In Ontario, the federal government administers the RITC’s, with the rate of recapture of ITC’s being 100% for the five years ending June 30, 2015 and then gradually being phased out as the recapture rate is dropped 25% per year thereafter. Refer to the table below outlining the phase-out dates and rates for the provincial component – 8%:

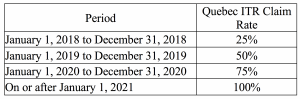

In Quebec, large businesses are currently allowed to claim ITR’s relating to specified property and services listed above at a rate of 25% of the QST payable or paid as of January 1, 2018, with the claim rates and phase-out periods further outlined in the table below for the provincial component – 9.97%:

Considering the changes, large businesses should ensure they have adjusted their internal reporting systems and calculations to factor in these changes to both account for the correct ITR rate and the rate of ITC recapture for specified property and services. These changes can not only affect direct purchases but can also affect employee reimbursements and allowances which generally include many of the restricted or recaptured expenses noted above.

For those large business that account for RITC’s in their HST/GST returns, they will need to account for these changes for the first period in which the ITC becomes available and ensure the rate has been accurately reflected in the first return following the change in recapture rate. Large businesses who have not reported the RITC correctly for prior periods must correct the particular reporting period related to the RITC. Businesses cannot adjust the current reporting period to remit any additional tax that may be owing, and misreporting can lead to penalties.

For more information or assistance on these changes and their impact on your business, contact us.