MARCH 27 UPDATE TO ARTICLE BELOW:

In addition to income tax and filing payment deadline extensions announced earlier (in our original article below), on March 27, the CRA introduced additional tax deadline extensions as follows:

Administrative tax measures

Administrative income tax actions required of taxpayers by the CRA that are due after March 18, 2020, can be deferred to June 1, 2020. These administrative income tax actions include returns, elections, designations and information requests.

These measures include additional deadline extensions as follows:

- T2 Corporate Income Tax Returns – The deadline for filing of corporate income tax returns due after March 18, 2020 is extended to June 1, 2020.

- T5013 Partnership Information Returns – The deadline for filing any income tax information return due after March 18, 2020 is extended to May 1, 2020.

- Trust Information Returns – The deadline for filing any income tax information return due after March 18, 2020 is extended to May 1, 2020.

- NR4 Non-resident Information Returns – The deadline for filing an NR4 information return is extended to May 1, 2020.

- T1134 Information Returns Relating to Controlled and Not-Controlled Foreign Affiliates – The deadline for filing any income tax information return due after March 18, 2020 is extended to June 1, 2020.

These measures specifically exclude the following:

- Payroll deductions payments and all related activities

- Form T661, Scientific Research and Experimental Development (SR&ED), Form T2038(IND), Investment Tax Credit (Individuals), Form T2 Schedule 31, Investment Tax Credit – Corporations, or any prescribed forms, receipts, documents or prescribed information related to these three forms.

Extending the deadline for filing an objection

For any objection request due March 18 or later, the deadline is effectively extended until June 30, 2020.

MARCH 20, 2020 ARTICLE: COVID-19 TAX FILING AND PAYMENT DEADLINES

On March 18, 2020, the Government of Canada released a series of financial measures to help combat the adverse financial effects of COVID-19 on businesses and individuals. On March 20, 2020, the Canada Revenue Agency issued additional guidance with respect to one of these measures – the tax filing and payment deadlines. This document summarizes this additional guidance.

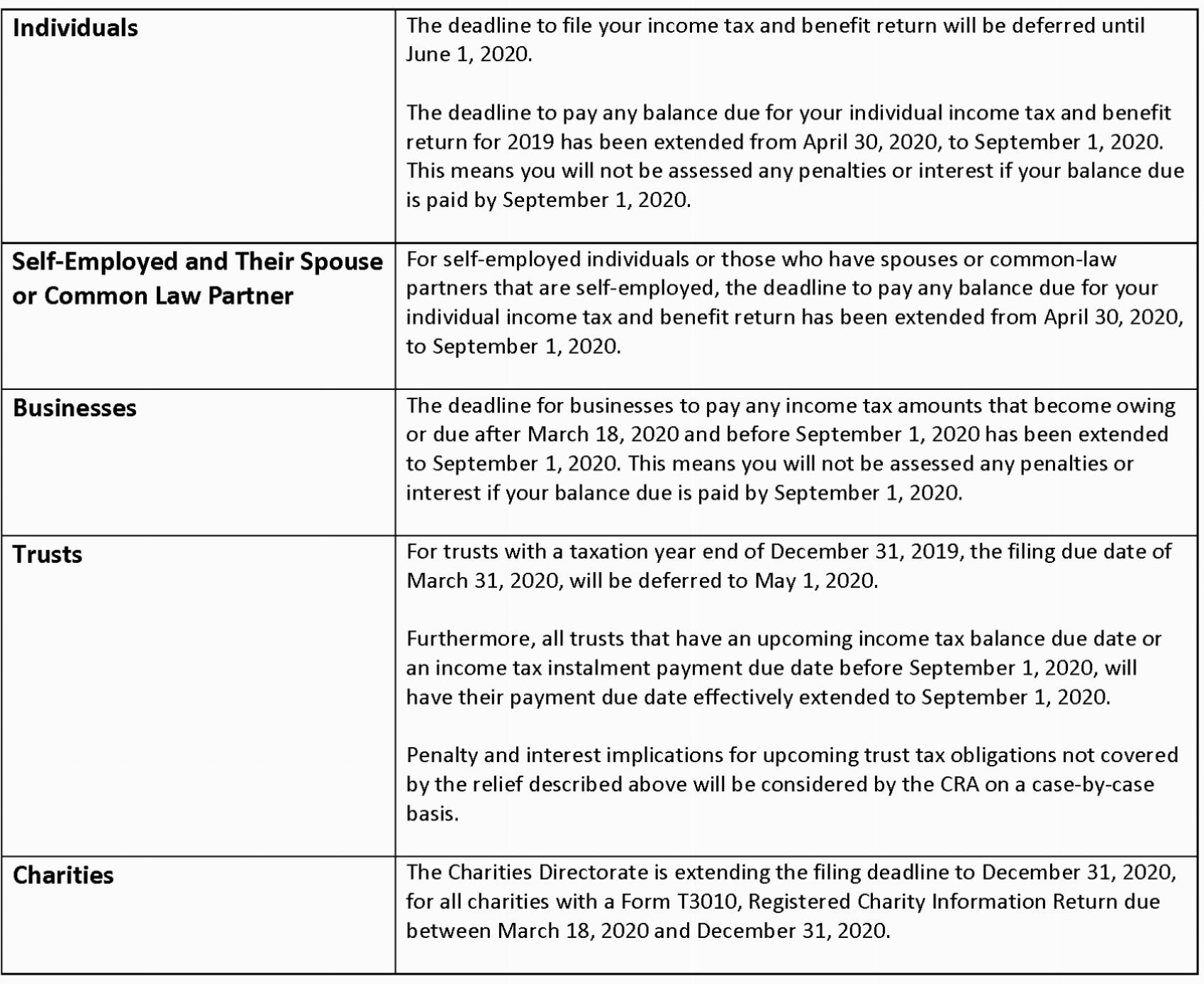

The table below summarizes the changes to filing and payment deadlines. In addition to deadline dates that have changed, it is important to note that some due dates have not changed. Filing due dates that have not changed include filings for :

- Corporations – T2 corporate income tax return SEE UPDATE ABOVE

- Partnerships – T5013 Statement of Partnership Income SEE UPDATE ABOVE

- Personal tax returns for self-employed individuals and their spouse or common-law partner

- T1134 – Information Returns Relating to Controlled and Not-Controlled Foreign Affiliates SEE UPDATE ABOVE

For an updated list of filing deadlines, we refer you to our original publication of January 2020, Statutory Filing Deadlines for Federal, Ontario, Québec and U.S. Governing Bodies, which has now been updated with the additional guidance issued on March 20, 2020.

Author

Partner