On November 30, 2020, the Minister of Finance and Deputy Prime Minister Chrystia Freeland delivered the 2020 Fall Economic Statement. Select highlights related to economic support for individuals and businesses are outlined below.

.

Tax Rates

There were no changes announced to personal or corporate income tax rates, capital gains inclusion rates, wealth tax, or the Goods and Services Tax (GST) rate.

.

Home Office Expense Deduction

To simplify the process for both taxpayers and businesses, the Canada Revenue Agency (CRA) will allow employees working from home in 2020 due to COVID-19 with modest expenses to claim up to $400, based on the amount of time working from home, without the need to track detailed expenses, and will generally not request that people provide a signed form from their employers. This measure will help taxpayers access deductions they are entitled to receive and simplify the tax filing process. Further detail will be communicated by the CRA in the coming weeks.

.

Employee Stock Options

The government is proposing the following changes to the employee stock option tax rules:

-

- A $200,000 annual limit will apply on employee stock option grants that can qualify for the employee stock option deduction. This limit will be based on the fair market value of the shares underlying the options, at the time the options are granted.

- Employee stock options granted by Canadian-controlled private corporations (CCPCs) will not be subject to the new limit. This responds to the government’s previously stated objective that start-ups not be impacted by this change.

- In recognition of the fact that some non-CCPCs could be start-ups, emerging or scale-up companies, non-CCPC employers with annual gross revenues of $500 million or less will also not be subject to the new limit.

The new rules will apply to employee stock options granted on or after July 1, 2021.

.

Support for Families with Young Children

Families entitled to the Canada Child Benefit will receive four additional payments in 2021 for children under age six. Families with income under $120,000 will receive $300 per child under age six, and those with higher income will receive $150 per child under age 6.

Support for Students

The government is proposing to eliminate interest on repaying the federal portion of the Canada Student Loans and Canada Apprentice Loans in 2021-22.

Canada Emergency Wage Subsidy

Support for active employees

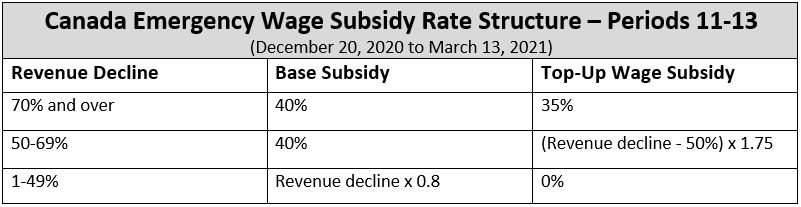

The maximum combined base subsidy and top-up wage subsidy rate is set at 65 per cent for the current qualifying period, which ends on December 19, 2020. The Government proposes to increase the maximum wage subsidy to 75 per cent for the eleventh to thirteenth qualifying periods, which run from December 20, 2020 to January 16, 2021, from January 17, 2021 to February 13, 2021 and from February 14, 2021 to March 13, 2021, respectively. The maximum base subsidy would remain at 40 per cent and the maximum top-up wage subsidy rate would increase to 35 per cent, as set out in the table below.

Furloughed CEWS

The Government proposes that the weekly wage subsidy for a furloughed employee from December 20, 2020 to March 13, 2021 be the lesser of:

- the amount of eligible remuneration paid in respect of the week; and

-

the greater of:

-

$500, and

-

55 % of pre-crisis remuneration for the employee, up to a maximum subsidy amount of $595.

-

Employers will also continue to be entitled to claim under the wage subsidy their portion of contributions in respect of the Canada Pension Plan, EI, the Quebec Pension Plan and the Quebec Parental Insurance Plan in respect of furloughed employees.

Reference periods

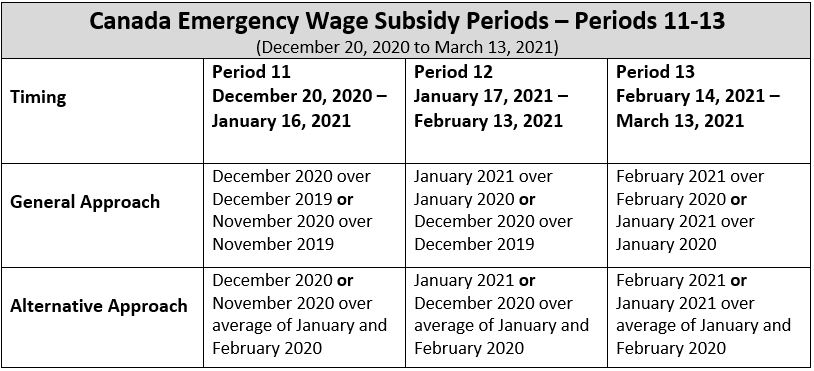

For the purposes of the wage subsidy (and the rent subsidy, as discussed below), an employer’s decline in revenues is generally determined by comparing the change in the employer’s monthly revenues, year-over-year. An employer may also elect to use an alternative approach, which compares the change in the employer’s monthly revenues relative to the average of its January 2020 and February 2020 revenues. A deeming rule provides that an employer’s decline in revenues for any particular qualifying period is the greater of its decline in revenues for the particular qualifying period and the immediately preceding qualifying period.

The table below outlines the proposed reference periods for determining an eligible employer’s decline in revenues from December 20, 2020 to March 13, 2021.

Employers that had chosen to use the general approach for prior periods would continue to use that approach. Similarly, employers that had chosen to use the alternative approach would continue to use the alternative approach. All the other parameters of the program would remain unchanged. Details for the wage subsidy for any periods beyond March 13, 2021 will be proposed at a later date.

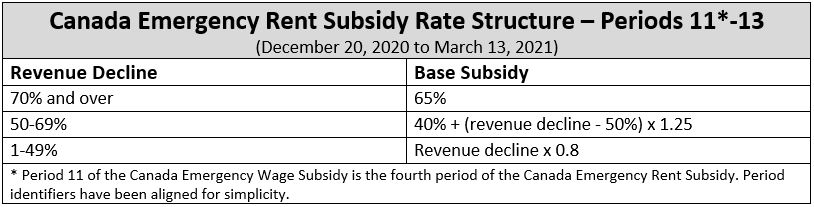

Canada Emergency Rent Subsidy

The government is proposing to extend the current subsidy rates of the Canada Emergency Rent Subsidy for an additional three periods. This means a base subsidy rate of up to 65 per cent will be available on eligible expenses until March 13, 2021.

Rate structure

The Government proposes to extend, until March 13, 2021, the current rate structure for the base rent subsidy (which applies until December 19, 2020), as shown in the table below.

Revenue decline calculation

Both the rent subsidy and the wage subsidy use the same calculation to determine an organization’s revenue decline. As a result, the same reference periods are used to calculate an organization’s decline in revenues for the wage subsidy and the rent subsidy. Likewise, if an entity elects to use an alternative method for computing its revenue decline under the wage subsidy, it must use that alternate method for the rent subsidy.

The Government also confirms its intention to proceed with the proposed change to the rent subsidy, details of which were announced on November 19, 2020, that would allow amounts to be considered to have been paid when they become due, provided certain conditions are met.

Details for the rent subsidy for any period beyond March 13, 2021 will be proposed at a later date.

Lockdown Support

The government is proposing to extend the rate of 25 per cent for the Lockdown Support for an additional three periods, until March 13, 2021. The new Lockdown Support program provides eligible entities with an additional 25 per cent top-up, in addition to the Canada Emergency Rent Subsidy base subsidy, until December 19, 2020.

Canada Emergency Business Account

The deadline to apply for a CEBA loan has been extended to March 31, 2021. Initially providing loans of up to $40,000, with up to $10,000 forgivable, the CEBA program will soon be expanded, allowing qualifying businesses to access an additional interest-free $20,000 loan, in situations where there is need. Half of this additional amount, up to $10,000, would be forgivable if the loan is repaid by December 31, 2022.

Fair Tax System for the Digital Economy

The government proposes a number of changes to level the playing field by ensuring that the GST/HST applies to all goods and services consumed in Canada, regardless of how they are supplied, or who supplies them. These changes are proposed to be effective July 1, 2021.

Taxation of Cross-Border Digital Products and Services

The government proposes that foreign-based vendors selling digital products or services to consumers in Canada be required to register for, collect and remit the GST/HST on their taxable sales to Canadian consumers.

Canadians also often purchase digital products or services through digital marketplace platforms (e.g., “app stores”). To ensure that the GST/HST applies equally to these sales, the government proposes that digital marketplace platforms be required to register for the GST/HST, and to collect and remit the tax on the sale of digital products or services of foreign-based vendors to Canadians that the platform facilitates. This will ensure greater fairness for Canadian retailers.

To help promote compliance, the government proposes that foreign-based vendors and digital marketplace platforms be able to register and account for the GST/HST under a special simplified regime.

Taxation of Goods Supplied through Fulfillment Warehouses

The government proposes to apply the GST/HST on all sales to Canadians of goods that are located in Canadian fulfillment warehouses. Under this proposal, the GST/HST will be required to be collected and remitted by either the foreign-based vendor or the digital platform that facilitates the sale.

Taxation of Short-Term Accommodation through Digital Platforms

The government proposes to apply the GST/HST to all platform-based short-term rental accommodation supplied in Canada. Under this proposal, the GST/HST will be required to be collected and remitted – by either the property owner, or the digital accommodation platform – on short-term accommodation that is supplied in Canada through a digital accommodation platform.

GST/HST Relief on Face Masks and Face Shields

The Government proposes to temporarily relieve (i.e., zero rate) supplies of certain face masks and face shields from the Goods and Services Tax/Harmonized Sales Tax (GST/HST). The zero-rating of the GST/HST would apply to face masks (medical and non-medical) and face shields designed for human use that meet certain specifications.

Sector Support

Support for Highly Affected Sectors

The government will work with financial institutions in the near term to create the Highly Affected Sectors Credit Availability Program (HASCAP) – a new program for the hardest hit businesses, including those in sectors, like tourism and hospitality, hotels, arts and entertainment. This stream will offer 100 percent government-guaranteed financing for heavily impacted businesses, and provide low-interest loans of up to $1 million over extended terms, up to ten years. Rates will be lower than those offered in BCAP and beneath typical market rates for hard hit sectors. The government will provide details on the Highly Affected Sectors Credit Availability Program soon.

Regional Relief and Recovery Fund

To better ensure the Regional Relief and Recovery Fund can continue to support small businesses unable to access other federal pandemic support programs, including replicating newly announced Canada Emergency Business Account loan limit increases, the government is proposing a top-up of up to $500 million, on a cash basis, to Regional Development Agencies and the Community Futures Network of Canada, bringing total funding to over $2.0 billion in this fund.

Included in these measures are the following:

- The government will earmark a minimum of 25 per cent of all the Regional Relief and Recovery Fund’s resources to support local tourism businesses, providing more than $500 million in program support through June 2021.

- The government will provide $181.5 million in 2021-22 to the Department of Canadian Heritage and the Canada Council for the Arts to expand their funding programs. This includes a one-year renewal of funding provided in Budget 2019 for the Building Communities through Arts and Heritage program, the Canada Arts Presentation Fund and the Canada Music Fund.

- To ensure that innovative, intellectual property-rich firms have the support they need to face the challenges presented by COVID-19, it is proposed that $250 million over 5 years, beginning in 2021-22, be provided to the Strategic Innovation Fund.

This article has been written in general terms to provide broad guidance only. It should not be relied upon to cover specific situations and you should not act upon the information contained herein without obtaining specific professional advice. Please contact our office to discuss this information in the context of your specific circumstances. We accept no responsibility for any loss or damage resulting from your reliance on the information in this article.

Author

Partner