A Not-for-Profit corporation is subject to specific rules pertaining to the type of report it is required to obtain for its financial statements. These reports vary with respect to the level of assurance that is obtained with each: from no assurance being obtained in a Compilation or Notice to Reader report, limited assurance being obtained in a Review Engagement Report, and reasonable assurance in an Audit Engagement Report.

To determine the type of report your Not-For-Profit corporation is required to obtain, you need three pieces of information: which Act it was incorporated under, the amount of public funds it receives, and its annual revenues.

INCORPORATING ACT

The act under which your Not-For-Profit corporation was incorporated (federal or provincially) will determine the rules it must follow. This article only focuses on federal and Ontario corporations. Both acts, the Canada Not-for-Profit Corporations Act (CNCA) at the federal level and the Ontario Not-for-Profit Corporations Act (ONCA) at the provincial level, contain specific requirements which mandate the level of assurance (if any) a Not-for-Profit corporation is required to obtain on its financial statements.

It should be noted that the ONCA is not yet fully enacted and accordingly, the rules described herein are based on the current wording of the legislation.

These rules will help a Not-for-Profit corporation determine the type of report their Public Accountant should be engaged to produce.

PUBLIC FUNDS

Corporations receiving public funds should be held to a higher standard than those that do not receive public funds. Under this guiding principle, both Acts impose additional requirements on corporations receiving public funds to ensure sufficient transparency and accountability for that income. Each Act has slightly different terminology and definitions to designate the receipt of public funds – the CNCA uses the term ‘soliciting corporation’ and the ONCA uses the term ‘public benefit corporation’.

CNCA – Soliciting Corporation

A corporation is considered soliciting when it has received more than $10,000 in income from public sources in a single financial year. Public sources include:

- gifts or donations from non-members;

- grants or similar financial assistance from the government (federal, provincial, or municipal) or an agency of such government;

- funds from another corporation that also received income from public sources.

A corporation is non-soliciting if it has received no public funds or less than $10,000 in public funds in each of its three previous financial years.

ONCA – Public Benefit Corporation

A corporation is considered a public benefit corporation when it is:

- a charitable corporation; or

- receives greater than $10,000 in a financial year either in the form of:

- donations or gifts from persons who are not members, directors, officers or employees of the corporation;

- grants or similar financial assistance from the government (federal, provincial, or municipal) or an agency of any such government.

- funds from another corporation that also received income from public sources.

ANNUAL REVENUE

The larger the size of your corporation, measured in terms of revenue, the higher the standard of accountability required. For example, the CNCA mandates all soliciting corporations with revenues over $250,000 and all non-soliciting corporations with revenues over $1M to have an audit. Similarly, the ONCA mandates all public benefit corporations with revenues over $500K to have an audit.

SUMMARY TABLES

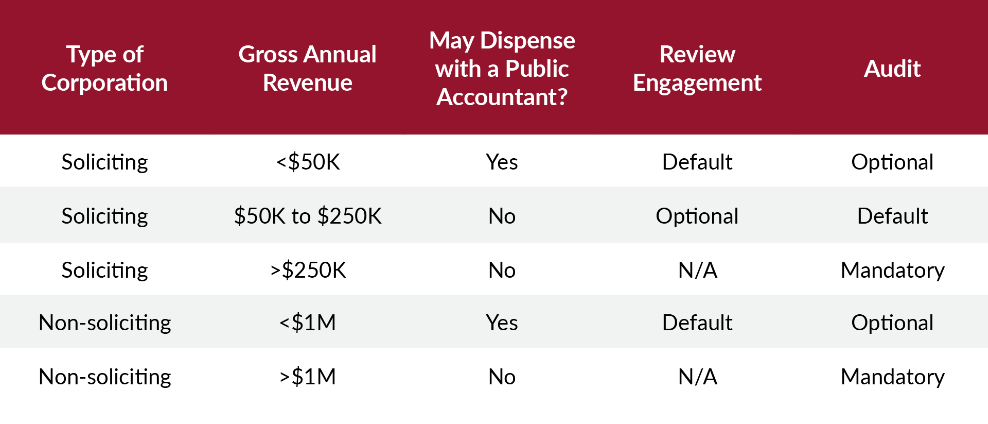

The tables below summarize the requirements under each Act. Where an organization wishes to deviate from the ‘default’ stipulated by each Act and the Act allows it to do so, special resolutions, as defined in each Act, are also required.

CANADA NOT-FOR-PROFIT CORPORATIONS ACT

ONTARIO NOT-FOR-PROFIT CORPORATIONS ACT

This article provides guidance of a general nature only and is not to be used as a substitute for professional advice. For specific advice pertaining to your Not-for-Profit corporation, you are advised to consult with your lawyer.

We take great pride in servicing the Not-For-Profit sector. Anjali Dilawri oversees our firms Not-For-Profit practice. For more information, reach out to us – we are here to help.

IN OUR OFFICE

Logan Katz – growing in leaps and bounds! We are pleased to announce the following exciting new additions to the LK team (left to right):

Naim Njaime – Staff accountant

Kathleen Cameron – Manager of Firm Administration & Human Resources

Niba Suhhu – Staff accountant

Alèxe Dumais – Staff accountant

Nina McGuire – Staff accountant

Baseball season is in full swing and the LK Bombers are all geared up to win the cup this year!

Our team members are: Matt Johnson, Wilson Li, Robert Campbell, Kyle Royer, Marie-Soleil Lee, Alex Fortier-Brynaert, Mary Le, Anjali Dilawri, Janice Ling, Alèxe Dumais, Shawn Roussy, Cole Van Wyk and James Bush.

Be sure to cheer us on!!! Here we are at our home opener, contemplating baseball strategies for the season ahead.

Did you see our new Facebook and LinkedIn pages? Did you like us yet? Please check out our new look. We’ve also been busy working on new branding for our website. We hope to launch it very soon – stay tuned!

IN OUR COMMUNITY

On May 6, David Logan cycled 70 km for the CN Cycle for CHEO. David was one of the top 5 fundraisers. David raised over $9,000 for the 10th anniversary of CN Cycle. Thank you to everyone who helped by contributing to David’s goal.We enjoyed a lovely evening at the annual Gala de L’Excellence du RGA, held at the Hilton Lac Leamy on May 30. For over 30 years, the Regroupement des gens d’affaires de la Capitale nationale has paid tribute to local businesses and business people that have distinguished themselves in various fields such as leadership, innovative spirit, their commitment towards the development of their business, their services or field of activity, the integrity of their organizations as well their commitment towards the francophone business community.

AROUND TOWN

It will take a long time to fully digest the recently introduced tax changes to private corporations and the implications these changes will have to our businesses. Gary Katz has been busy educating and informing our business community. His most recent presentation to members of Entrepreneur Organization Ottawa (EO Ottawa) helped bridge the gap of understanding in this complex area. Contact Gary if you need assistance or require information regarding these recently enacted changes.

Trevor Kennedy lends his expertise as a reviewer every month at Lead to Win at Bayview Yards for their Opportunity Review Day. Lead to Win is an award-winning business development program with the objective of establishing and growing businesses in Canada’s National Capital Region. Logan Katz is a proud supporter and committed collaborator of Carleton University’s Lead to Win program.

No matter your business model, a lack of attention to financial information will hurt your business. Throughout the year, David Logan presents a hands-on workshop at Invest Ottawa at Bayview Yards to help participants understand how to develop sound financial projections and a working cashflow model, as well as interpret related financial statement components. Logan Katz is a proud partner of Invest Ottawa.

Startup Garage 2018 season is off to a great start! Startup Garage is a 3-month program led by the University of Ottawa to foster and support youth entrepreneurship. Logan Katz is a proud sponsor of the Startup Garage program.