On March 28, 2018, Finance Minister Charles Sousa tabled Ontario’s fiscal 2018-19 budget. The budget proposes several tax measures which would affect individuals and businesses. This month’s edition of the Learning Kurve provides an overview of the significant tax measures proposed.

PERSONAL TAX MEASURES

Personal Income Tax Rates

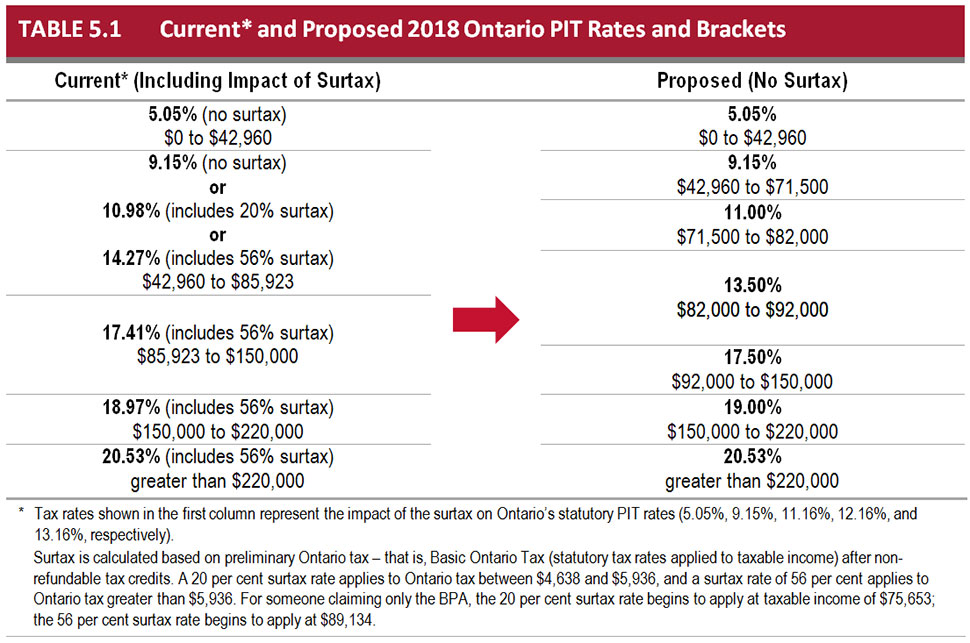

The government proposes to eliminate the surtax and make adjustments to the personal income tax brackets and rates, effective for the 2018 tax year. The surtax functions as a tax on tax, rather than a tax rate applied directly to taxable income.

Ontario currently has five statutory personal income tax rates plus two surtax rates calculated separately. The proposed change, aimed at simplifying the personal income tax calculation, would create seven statutory personal income tax rates applied directly to taxable income.

The table below, available on the Budget Ontario website, shows the current 2018 statutory personal income tax rate structure as compared to the proposed 2018 structure.

Ontario Charitable Donation Tax Credit (OCDTC)

The government proposes to increase the top rate of the non-refundable OCDTC, which provides relief to taxpayers who make eligible charitable donations. Currently, an OCDTC rate of 5.05% applies to the first $200 in donations and a rate of 11.16% for donations that exceed $200.

The effect of the surtax calculation described above means the OCDTC rate can climb up to 17.41% for surtax payers. Ontario proposes to increase the OCDTC rate to 17.5% for all taxpayers for eligible donations exceeding $200, effective for the 2018 tax year. The first $200 of donations would continue to be eligible for an OCDTC rate of 5.05%.

Eliminating the interaction of the OCDTC with the surtax means that taxpayers receive the same relief from the OCDTC.

Paralleling Federal Measures

Income Sprinkling

Income sprinkling involves diverting income from a high-income individual to family members in whose hands the income would be taxed at lower combined federal–provincial personal income tax rates. Currently, income shifted to minor children is taxed at the highest combined federal–provincial personal income tax rate — also known as tax on split income. The federal government recently announced measures to address income sprinkling by extending the tax on split income rules to adult family members who are not active in the business, with certain exceptions, beginning with the 2018 taxation year.

Ontario will automatically parallel these changes once federal amendments are approved and apply its top personal income tax rate of 20.53% to split income received by an adult family member.

Closing Tax Loopholes

In its 2018 budget, the federal government introduced two measures to address the use of sophisticated financial instruments and structured share repurchase transactions by certain Canadian financial institutions to realize artificial tax losses. These measures include proposed amendments to the “synthetic equity arrangement” and “securities lending arrangement” rules, as well as a specific stop-loss rule applicable to share repurchase transactions.

To support the federal measures that deny artificial tax losses realized on these types of structured transactions, Ontario will automatically parallel these changes once federal legislation is approved.

BUSINESS TAX MEASURES

Corporate Income Tax Rates

No changes were proposed to the corporate income tax rates.

The Small Business Limit

Ontario’s small business deduction reduces the Ontario general corporate income tax rate for small Canadian-controlled private corporations (CCPCs) and associated corporations, on up to $500,000 of qualifying active business income. The $500,000 business limit is phased out on a straight-line basis for CCPCs (and associated corporations) that have between $10 million and $15 million of taxable capital employed in Canada.

The 2018 federal budget proposed an additional phase out of the federal small business limit. Effective for taxation years beginning after 2018, the federal small business limit would also be phased out on a straight-line basis for CCPCs (and associated corporations) that earn between $50,000 and $150,000 of passive investment income in the taxation year.

The business limit of a corporation would be the lower of the business limit determined on the basis of taxable capital and the business limit determined on the basis of passive investment income.

Ontario proposes to parallel the federal measure on passive investment income, effective for taxation years beginning after 2018.

The Ontario Research and Development Tax Credit

The government proposes to enhance the Ontario Research and Development Tax Credit (ORDTC).

The ORDTC is a 3.5% non-refundable tax credit on eligible research and development (R&D) expenditures. Effective for eligible R&D expenditures incurred on or after March 28, 2018, companies that qualify for the ORDTC would be eligible for an enhanced rate of 5.5% on expenditures over $1 million in a taxation year. The $1 million threshold would be prorated for short taxation years.

This enhanced tax credit rate would not be available to businesses where eligible R&D expenditures in the current taxation year are less than 90% of eligible R&D expenditures in the prior taxation year. Eligible R&D expenditures in short taxation years would be increased to the full year equivalent. For the purposes of calculating eligible R&D expenditures in the prior taxation year, when a corporation is amalgamated with, or wound up into, another corporation, each predecessor corporation’s eligible R&D expenditures would be considered transferred to the successor.

The enhanced tax credit rate would be prorated for taxation years straddling March 28, 2018.

The Ontario Innovation Tax Credit

The government proposes to enhance the Ontario Innovation Tax Credit (OITC), an 8% refundable tax credit for companies on eligible R&D expenditures.

For eligible R&D expenditures incurred on or after March 28, 2018, if a company qualifies for the OITC and has a ratio of R&D expenditures to gross revenues that is:

- 10% or less, the company would remain eligible for the OITC at the 8% rate;

- Between 10% and 20%, the company would be eligible for an enhanced OITC rate that would increase from 8% to 12% on a straight-line basis as the company’s ratio of R&D expenditures to gross revenue increases from 10% to 20%; and

- 20% and above, the company would be eligible for the OITC at a 12% rate.

For the purposes of this calculation, both the gross revenues and R&D expenditures must be attributable to Ontario operations. Gross revenues and R&D expenditures attributable to Ontario operations of associated corporations would be aggregated.

The rate enhancement would be prorated for taxation years straddling March 28, 2018.

Ontario Interactive Digital Media Tax Credit

Ontario proposes an amendment to the Taxation Act, 2007, to extend eligibility for the Ontario Interactive Digital Media Tax Credit to film and television websites purchased or licensed by a broadcaster and embedded in the broadcaster’s website. The amendment would apply to websites that host content related to film, television or Internet productions that have not received either a certificate of eligibility or letter of ineligibility before November 1, 2017.

The Commercialization of Intellectual Property

A number of countries have implemented tax incentives, such as patent boxes (i.e., preferential CIT rates), refunds of taxes paid, tax deductions and exemptions to retain the economic and social benefits from intellectual property. Ontario is reviewing all of these initiatives for effectiveness and feasibility and will develop a provincial incentive aimed at encouraging intellectual property ownership to be retained in the province.

Employer Health Tax

The government proposes measures to better target the Employer Health Tax (EHT) exemption. The exemption is available to employers who would not be eligible for small business relief under the federal Income Tax Act (ITA) through the Small Business Deduction (SBD).

Ontario proposes to follow the eligibility criteria for the SBD for the EHT exemption. As a result, the exemption would only be available to individuals, charities, not-for-profit organizations, private trusts and partnerships, and Canadian-controlled private corporations.

Ontario would incorporate federal anti-avoidance rules related to the multiplication of the SBD into the Employer Health Tax Act. Ontario would also determine the EHT rate for associated employers in a way that is consistent with the application of the EHT exemption threshold for these employers.

Legislation for these proposed changes, if passed, would become effective January 1, 2019. There will be an opportunity for public comment before the legislation for the anti-avoidance changes is introduced.

OTHER TAX MEASURES

Land Transfer Tax Reporting Requirements

Ontario plans to make a new regulation that would allow land transfer tax arising from certain unregistered dispositions of a beneficial interest in land through certain types of partnerships and trusts to be payable 30 days after the end of the calendar quarter in which the disposition occurred, rather than within 30 days of the disposition.

Taxation of Cannabis

Ontario intends to enter into an agreement with the federal government under which Ontario would receive 75% of the federal excise duty collected on cannabis intended for sale in the province.

Consistent with the treatment of alcohol and tobacco, it is the Ontario government’s intention for the full HST to apply to off-reserve purchases of recreational cannabis once legalized. A Status Indian registered to obtain medical cannabis from a licensed producer in accordance with federal law will continue to be eligible for a rebate of the 8% Provincial portion of the HST for purchases that are delivered off-reserve.

BREAKING NEWS

IRS Offshore Voluntary Disclosure Program ends September 28, 2018

The Internal Revenue Service has been actively engaged in identifying non-reporting of foreign accounts in recent years. On March 14, 2018, the IRS announced that they will discontinue the Offshore Voluntary Disclosure Program (OVDP) effective September 28, 2018.

The OVDP is a voluntary disclosure program specifically designed for taxpayers with exposure to potential criminal liability and/or substantial civil penalties due to a willful failure to report foreign financial assets and pay all tax due in respect of those assets. The OVDP is designed to provide to taxpayers with such exposure (1) protection from criminal liability and (2) terms for resolving their civil tax and penalty obligations.

For assistance in resolving your filing omissions, contact our cross-border specialist, Shawn Roussy <mailto:> (613-228-8282, extension 114).

IN OUR OFFICE

We are all hands on deck this month as we work hard to ensure all your taxation needs are well taken care of! We keep ourselves energized by several special staff treats throughout the month. One of our favorite highlights – Bev Carroll of Espresso Uno whipped up a variety of speciality coffees and morning pastries. Our staff enjoyed having great coffee and sweet treats to start the day off right on a Saturday morning!

Have you noticed our new branding on the Logan Katz Facebook and LinkedIn pages? Take a look and LIKE us. Keep a watch for more branding updates coming soon!

Here we grow again! We wish a warm welcome to our new full-time Staff Accountant, Alex Fortier-Brynaert and our new Administrative Receptionist, Jessica Joly. Welcome to our team!

We thank our fantastic students, Brennan Sloan, Patrick Seredy, and Erhan Yilmaz, for their hard work during our busy season and wish them well as they complete their 4 month co-op work term and return to their academic studies at the University of Ottawa.

We are very proud of Mary Le who has recently obtained her CPA designation. Congratulations, Mary – the world is your oyster!

IN OUR COMMUNITY

On May 6 David Logan will be participating in the CN Cycle for CHEO 70 km ride to ensure that CHEO remains a leader in creating better treatment options and finding new cures so that more kids survive cancer.

Thanks to your generous support, David is consistently the event’s top fundraiser and has raised approximately $30,000 from his 2014 to 2017 rides. David hopes to raise a similar amount this year to help CHEO continue their life-saving work. To make a secure on-line donation, please click on David’s fundraising page.

On April 19, Logan Katz attended and proudly supported, as the Emerging Entrepreneur category sponsor, the BYAs Businesswoman of the Year Awards gala, where this year’s winners were revealed:

- Linda Eagen, Founder Cancer Coaching, President and CEO Ottawa Regional Cancer Foundation

- Donna Baker, Co-Founder, Keynote Group

- Cathy Hay, ARIDO IC, PMP, LEED AP President and Founder, Hay Design Inc.

- Karen Hennessey, Partner, Gowling WLG (Canada) LLP

Congratulations to the four deserving recipients as well as to all the extraordinary finalists!

AROUND TOWN

Our road show continues to take us all over town as we educate our business community on corporate taxation and the impact of the recent changes to the taxation of private corporations.

- Trevor Kennedy and a team from CIBC co-hosted a small business seminar on the new tax changes at the Barrhaven Business Improvement Area.

- Gary Katz and Trevor Kennedy and IP Strategies co-presented to local on considerations on when to incorporate.

Contact us <mailto:> to learn more about corporate taxation – how to set up an optimal corporate structure and how to take advantage of mechanisms available to you to minimize your taxes and maximize your profits. We would be pleased to set up a presentation for your company or business group or to provide you with one-on-one professional advice.

Ottawa continues to assert itself as a major technology hub! Trevor Kennedy and David Logan have extensive expertise serving clients in the technology space. Give them a call and let’s talk tech!

- Trevor Kennedy attended and met some of the amazing startups celebrated at this year’s L-SPARK’s SaaS Showcase, which was held at the Brookstreet Hotel on April 17, 2018. L-SPARK’s SaaS Showcase is a celebration of startups, it’s an opportunity to connect face-to-face with members of the tech community and it’s an insider’s look into what these companies are building.

- Trevor Kennedy attended the annual Ottawa Autonomous Vehicle Summit on April 4. The event featured David Keene, CEO of Aurrigo Canada, which recently selected Ottawa for its North American headquarters. Great work by Invest Ottawa to promote Ottawa as THE place to establish technology and innovation development centers.

We have a vibrant academic community in Ottawa and it’s always a pleasure to watch our own brilliant business minds at work!

- Thank you to Kyle Royer, who provided his business expertise in judging the Algonquin Business Planning Class Competition on April 11.

- Congratulations to our very own Cole van Wyk and Robert Campbell and their team members Alex Chaiban, Clara Ferland, and Celine Daoud for winning the CPAO Case Competition at the Telfer School of management at Ottawa University on April 12, 2018.